Why are Microsoft and Sony going on an acquisition spree, and who is the next target?

The future is anyone's game.

It's been a busy time for gaming acquisitions. Companies are getting eaten by one another, alliances are shifting, and Game Pass content lineups are growing thick and fast. But what do these deals mean if you drill past their easy-to-understand exteriors?

Microsoft didn't spend nearly $70 billion on Activision Blizzard solely to get enhanced title access for Game Pass. Sony didn't buy Bungie just to have Destiny. There are layers to these purchases that extend well beyond the superficial components, and even past the less apparent angles. In other words, there's likely even more depth to the recent buys than just Microsoft gaining King for mobile endeavors and Sony securing the talented company known for birthing famous FPS franchises.

We reached out to experts to find out what the real hidden benefits are of the two recent mega-acquisitions and score insights on which company may be next to get gobbled.

The next target

With two massive purchases happening in such close proximity to each other, the questions are: "Why are they happening now," and "Who's next?"

Lewis Ward, IDC Research Director of Gaming, eSports, and VR/AR, stated that the acquisition insanity may very well die down from here.

"I'm not expecting Sony or Microsoft to make another large acquisition this year," he said. "These deals take time to come together and will need to be digested internally. A few private studios may get picked up but I doubt that either company will make another multibillion-dollar studio/publisher acquisition in 2022, let alone a deal valued in the tens of billions."

As for the timing of the two massive deals to have already graced 2022, Ward didn't think the events were directly related. He pointed out that deals of such magnitude are usually the result of at least nine months' work and typically aren't announced until the paperwork's finished. With that said, he did feel Microsoft's buy had signs of being a bit more rushed.

All the latest news, reviews, and guides for Windows and Xbox diehards.

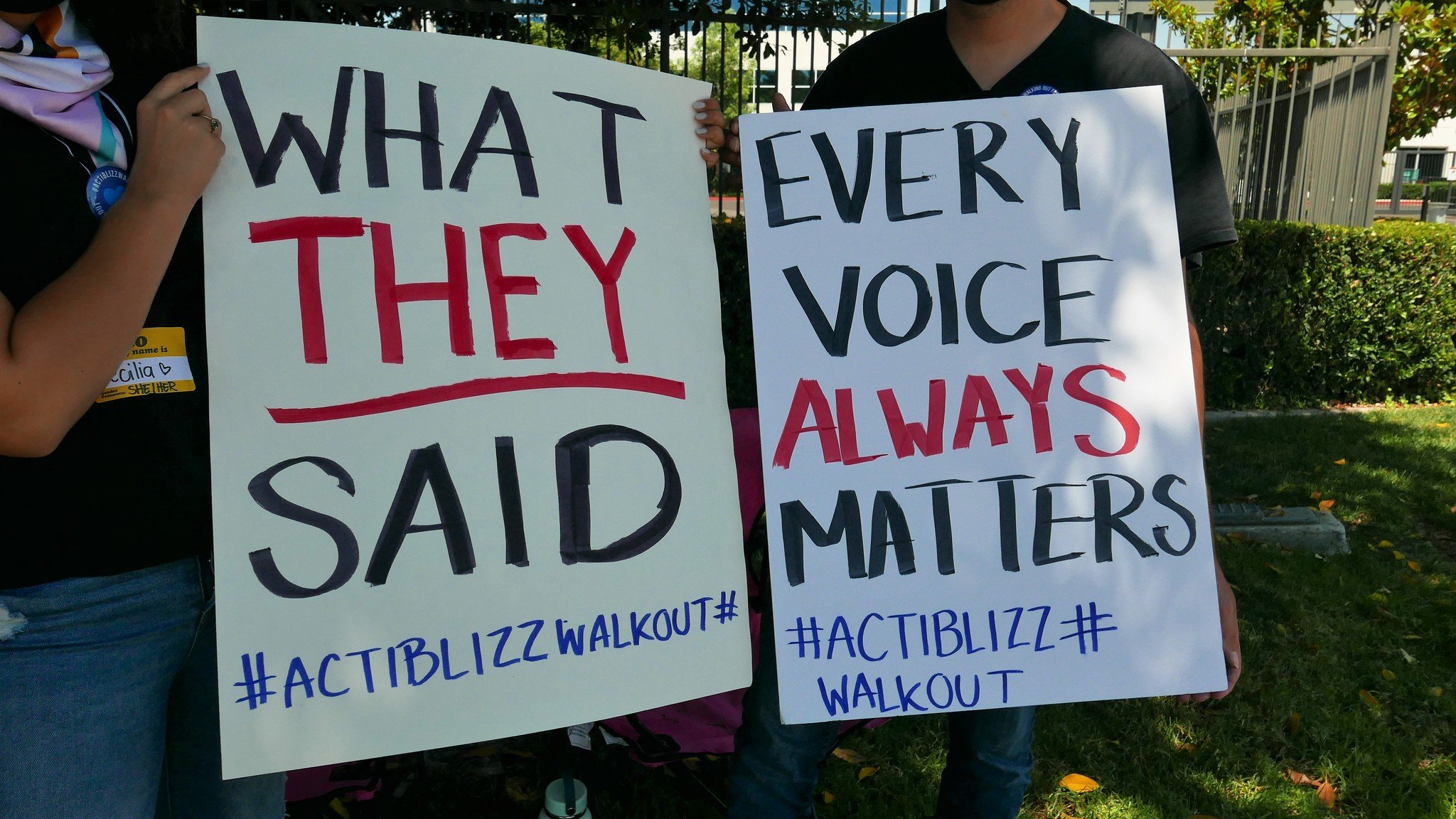

To preface what comes next: Remember that before Microsoft made its announcement, Activision Blizzard had been embroiled in a sexual harassment nightmare involving lawsuits, worker strikes, and a seemingly unending string of toxic workplace claims. All of these things took place with Activision Blizzard CEO Bobby Kotick at the helm.

"The deal was announced in mid-January," Ward said. "That Activision Blizzard's CY 4Q 2021 results would miss investor expectations in early February was clear to Activision Blizzard execs late last year. On top of that, Bobby Kotick, CEO of Activision Blizzard, was looking down the barrel of multiple lawsuits going into Activision Blizzard's investor day in June. There's a very good chance that Mr. Kotick would have been forced to resign coming out of that meeting. This deal saved his bacon. If you're ousted you get nothing. This way he's slated to get $390 million."

"It wasn't imaginable that Activision Blizzard would be bought out, yet here we are."

Ward stated such factors were likely a key part of the "why now" angle of the deal, as opposed to what was probably a more classical acquisition process with Sony and Bungie.

Forrester Analyst Will McKeon-White, for his prediction of which company may get bought next, said that it was tricky to determine the next target at the current juncture.

"Acquisition target definition has radically changed," he said. "It wasn't imaginable that Activision Blizzard would be bought out, yet here we are."

He provided criteria for what could determine the next company willing to sell itself. "If you don't have a working hit or an earnings miss, it can shut down the entire publisher," he stated, highlighting that a company that'd want financial insulation and the associated creative benefits of such protection would make for a good contender, naming Capcom and Sega as examples.

The company itself would also need to provide benefits to its buyer in the form of unique form factor capabilities and a diverse intellectual property (IP) portfolio. McKeon-White cited EA as a company that'd fit this end of the equation.

The Game Pass rival

Sony's rumored Game Pass rival hangs heavy over the conversation. Though that speculated service likely wasn't the impetus for a Bungie acquisition, it certainly may have been a part of the conversation around building up a portfolio to rival Microsoft's ever-expanding Game Pass lineup.

This could easily constitute one of the less-discussed benefits of Sony's purchase. We know the tech giant is getting Destiny and a team of world-class first-person shooter (FPS) developers out of the deal, but could this also be Sony figuring out how it can properly rival Game Pass? Even if Destiny and whatever else Bungie cooks up remain multiplatform (which Ward stated he expects to be the case), the perks of having that studio directly under one's control cannot be underestimated. Timed DLC, exclusive content, early access — the possibilities are limitless.

Two Game Passes could undo the $60-70 upfront price model.

Here's where the real food for thought comes into play: If Microsoft's already got a massive chunk of publishers and developers putting their games on Game Pass day one, then Sony's Game Pass rival would logically need to sweep up all the high-profile titles that remain to stay competitive. In other words, outside of Nintendo releases, we could very well be looking at the end of the $60-70 game as the only way to access a new title, since anyone may soon be able to buy into a Microsoft or Sony Game Pass sub for dirt cheap (or free, if you use Bing).

Publishers have awoken to the possibilities of reduced admission fees or simply going all-in on free-to-play models, a fact McKeon-White highlighted in his analysis of the current gaming landscape. "The most successful titles of [this] recent half-decade have been free to play," he stated.

With that in mind, it's not like the $60-70 model will just disappear overnight. McKeon-White pointed to Ubisoft as an example of how a publisher could have a hand in every pot. It has games on Ubisoft Connect, the Epic Games Store, and it recently launched Rainbow Six Extraction day one on Game Pass. If we overlook its exclusion of Steam, Ubisoft is essentially saying it'll meet customers where they are, even if that means Ubisoft's not directly gaining $60 per person.

"We might see that driving down entry price as [publishers] see the value there," McKeon-White said. He also had this to say when asked about whether he foresaw Sony's hypothetical Game Pass competitor coming to PC: "It would be smart if it does."

We've seen Sony start to embrace modern PC gaming over on Steam, and technically, Sony already gave PC players Marvel's Spider-Man and the Uncharted games via PS Now, so it's not like the company is afraid to tango with the platform. Given the success of Microsoft's Game Pass and the best Xbox Game Pass games, perhaps Sony will copy that format and enable the PC to be an all-in-one (sans Mario) solution.

The testing ground

Though most people have already sussed out the more obvious perks of Microsoft buying Activision Blizzard, including large gains in the poorly defined "metaverse" space, access to Call of Duty and other world-renowned IPs, as well as increased strength in the mobile sector thanks to King, there's more to the nearly $70 billion purchase than meets the eye. Chiefly: What does it do for Azure?

Though Activision Blizzard had a big deal with Google Cloud for cloud hosting infrastructure, there's a question as to what happens next. Does that agreement die prematurely or run its course? Either way, eventually, it's all but inevitable that Microsoft's going to get Azure injected into the mix. McKeon-White commented on this topic, highlighting a potential major benefit of the deal not everyone's acknowledged.

"It will certainly allow Microsoft to experiment internally with what makes the best technology services for a game provider at a scale of ecosystem that might not have been entirely comparable before," he said. Once Microsoft figures out how to harness Azure within the framework of Activision Blizzard's properties as well as its own, at that point, it'll have an incredibly strong portfolio piece with which to show other companies when asked, "Can Azure handle the task?" As a demonstration of sheer technological power, this acquisition's Azure implications could be big.

The positions behind the purchases, in summary

To make a long story short, Microsoft's and Sony's recent moves could be the setup for far grander things than most have already speculated. Sure, Microsoft's Game Pass, mobile gaming power, and "metaverse" get a bump thanks to Activision Blizzard, and Sony gets a talented studio and popular multiplatform FPS. But there are more perks to each lurking under the surface.

Sony buying Bungie may very well be fuel for the fire of an upcoming Game Pass rival service, the likes of which could signal the end of day-one $60-70 games. And Microsoft's Activision Blizzard buy may very well prove to be the ultimate testing ground for Azure, which has become a top-tier priority for Redmond in recent years.

While these grander implications are speculation at the moment, they're all born from logic and precedent. Don't be surprised if the gaming landscape changes even more radically in response to these two acquisitions that have already shaken the industry's foundations.

Robert Carnevale was formerly a News Editor for Windows Central. He's a big fan of Kinect (it lives on in his heart), Sonic the Hedgehog, and the legendary intersection of those two titans, Sonic Free Riders. He is the author of Cold War 2395.