Rumored NVIDIA-ARM acquisition could massively shake up the chip industry

This could massively shake up the semiconductor industry.

What you need to know

- NVIDIA has allegedly approached SoftBank Group Corp with an offer to purchase full stakes in Arm Holdings.

- This would likely be the largest-ever acquisition in the chip industry.

- NVIDIA's shares have risen by 76% in the last year.

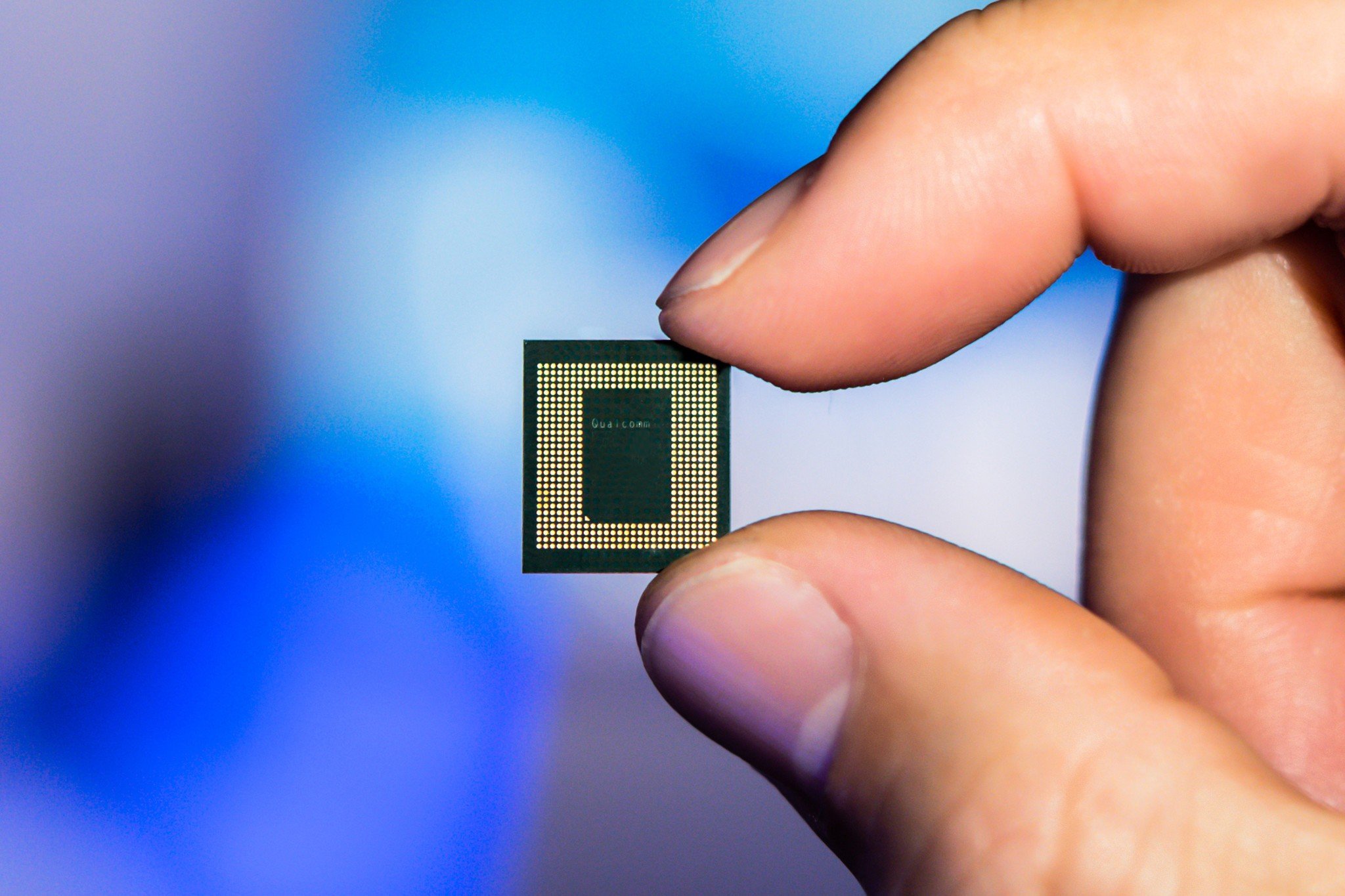

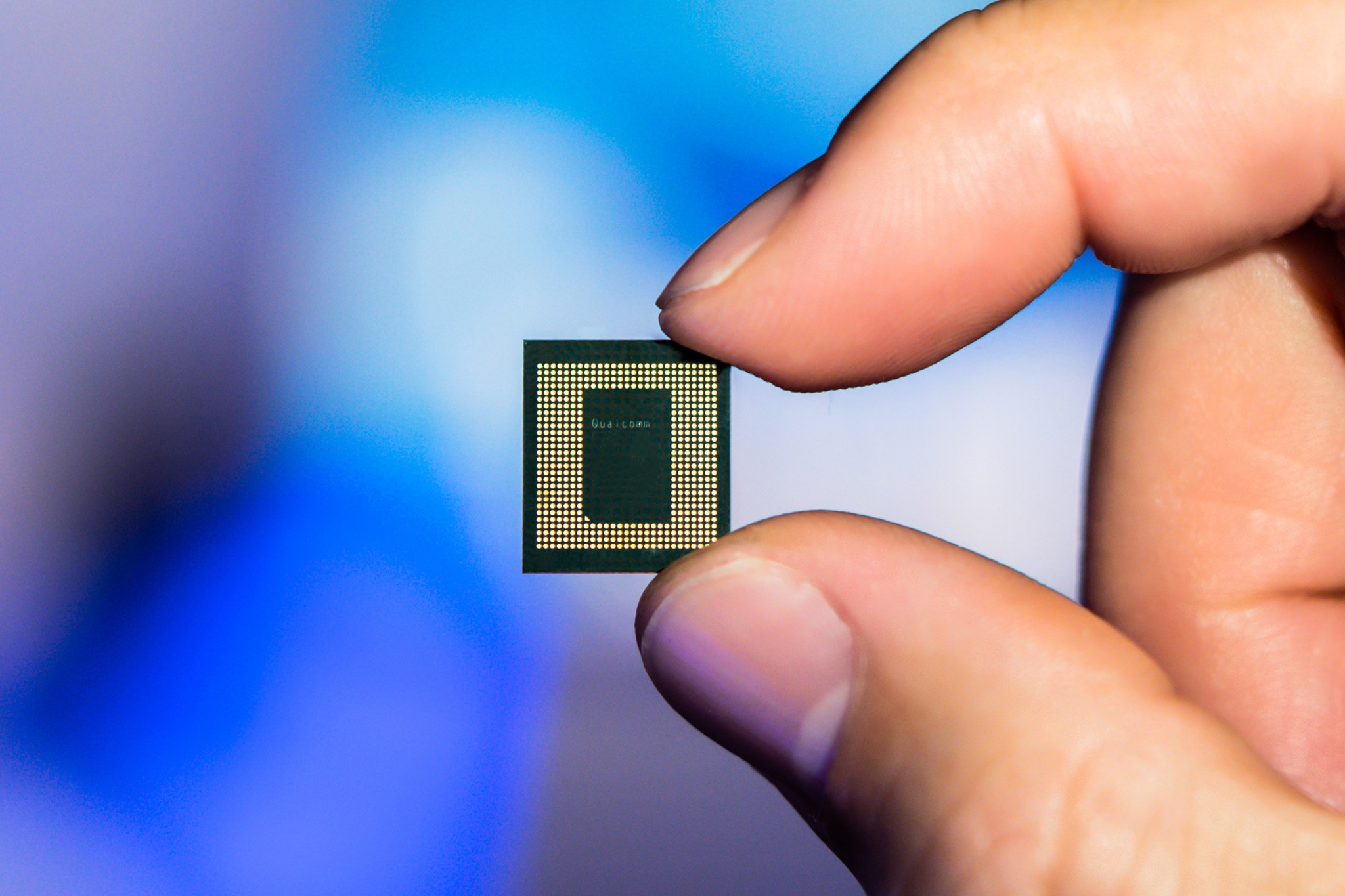

ARM chips power an enormous number of electronics worldwide, including virtually every phone and tablet, and according to a report from Bloomberg, it seems that NVIDIA could potentially be eyeing a takeover of the Cambridge-based company.

Arm Holdings is currently owned by SoftBank Group Corp, a massive holding company operating in countless segments such as broadband, e-commerce, advertising, and telecom services — including Sprint in the U.S. Following a report earlier this month that SoftBank was reviewing options to sell Arm Holdings, NVIDIA Corp (based in Santa Clara, CA) has allegedly made an offer for an undisclosed amount. This comes following a 76% rise in NVIDIA's share values this year.

Though we don't yet know the terms or status of NVIDIA's proposal, such a deal would massively shake up the semiconductor industry, and could raise some anti-competitive concerns from regulatory bodies. Still, if approved, a full buyout would likely be among the largest acquisitions in the history of the chip industry.

How SoftBank's sale of Arm Holdings could go very right, or terribly wrong

Get the Windows Central Newsletter

All the latest news, reviews, and guides for Windows and Xbox diehards.