Trump tariffs LIVE: PC shipments surged to prep for tariffs, NVIDIA faces AI GPU challenges in China (again)

Here is how the latest US tariffs affect PC makers, gaming companies, chip manufacturers, and consumer electronics pricing.

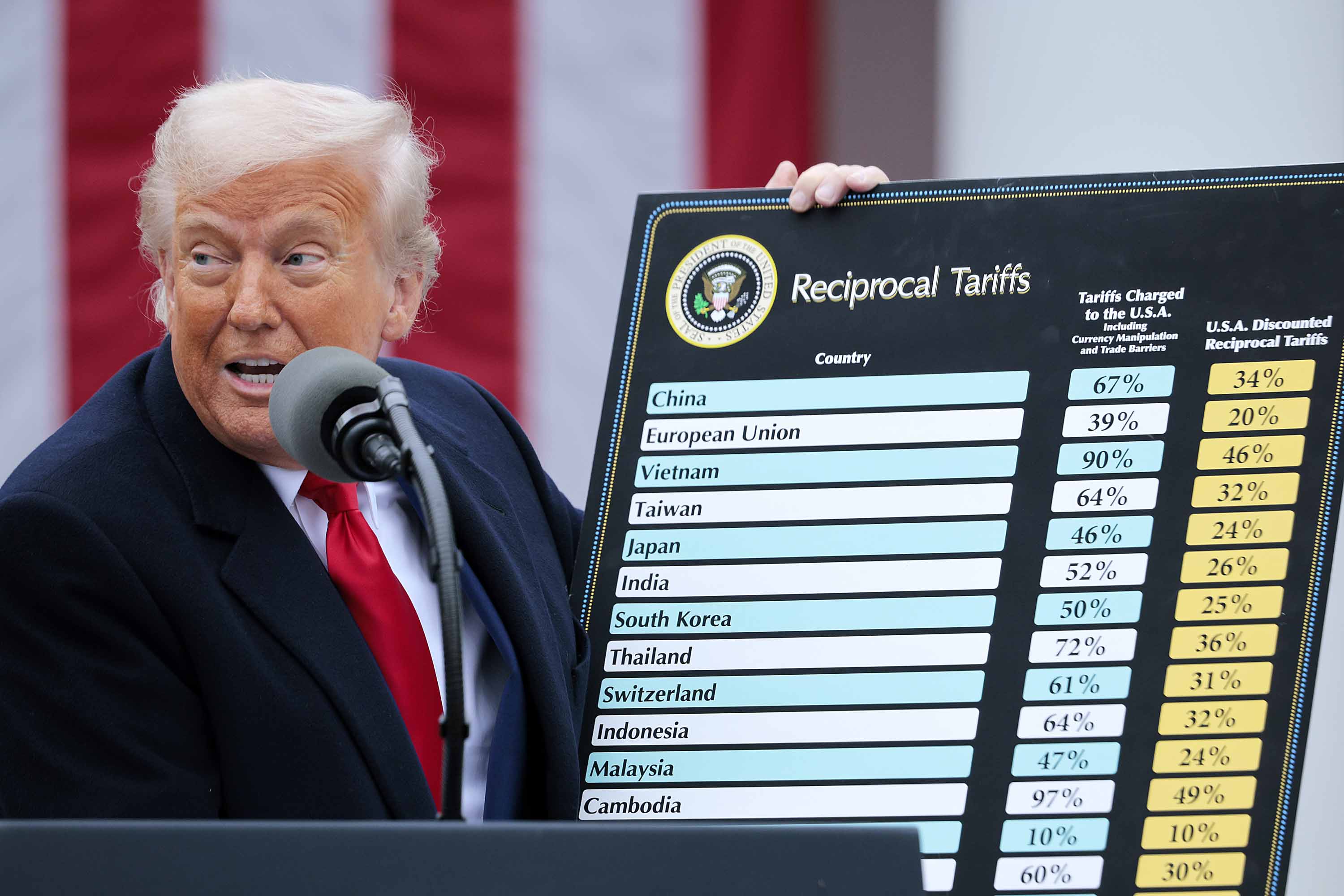

In 2025, tariffs gained prominence as the Trump administration suddenly raised tariffs across over 70 countries. The goals include encouraging U.S.-based manufacturing to avoid tariffs, renegotiating trade agreements to prioritize American interests, and generating revenue to offset tax cuts.

The tech industry has been hit hard, particularly consumer electronics like PCs, laptops, GPUs, and gaming consoles. Many of these products are manufactured in China, where high tariffs have led to price hikes or supply shortages. Companies like Razer have even paused imports of new devices to the U.S., and pricing on the Legion Go S and MSI Claw have increased, highlighting the tariffs' challenges to businesses and consumers.

For example, let's say the US imposed a 125% tariff on goods from China on April 9th, 2025 (which actually happened). A company importing a $1,000 laptop from China must now pay $1,250 as a tax.

So, instead of a $1,000 laptop, it would now cost $2,250!

Of course, due to the chaotic nature of the Trump administration, the news cycle is rapidly shifting, meaning this "trade war" could last days, weeks, months, or even years.

Here, you'll find all the latest breaking news related to those tariffs and how they affect PCs, gaming, laptops, and major companies like Microsoft, HP, Dell, and more.

PC sales surge pre-tariff as companies stock up for trade war

In reaction to the many months of tariff threats, PC makers took notice by increasing shipments in anticipation of later price increases for US imports.

A report from Canalys, which came after the tariff announcements but uses data from January to March, shows that shipments of PCs, laptops, and workstations "grew 9.4% to 62.7 million units," and more specifically, laptops (including mobile workstations), grew 10% (49.4 million units).

Lenovo leads in most shipped computers by far, followed by HP, Dell, and Apple.

However, shipments do not equal sales, and the increase is most likely attributed to pre-tariff jitters:

“PC shipments experienced a surge in Q1 2025, driven by vendors accelerating deliveries to the US in anticipation of initial tariff announcements ...This preemptive strategy allowed manufacturers and the channel to stock up ahead of potential cost increases, boosting sell-in shipments despite otherwise stable end-user demand” said Ishan Dutt, Principal Analyst at Canalys

Of course, companies could only execute such a strategy for already-released laptops, whereas ones hitting store shelves now (or in the coming weeks), like the Razer Blade 18, likely missed the chance.

The good news is that early-2025 laptops and PCs should have stable prices—that is, until stock runs out. At that point, we'll have to see where the tariffs and trade war with China stand.

You can read more in our full article. — Daniel Rubino

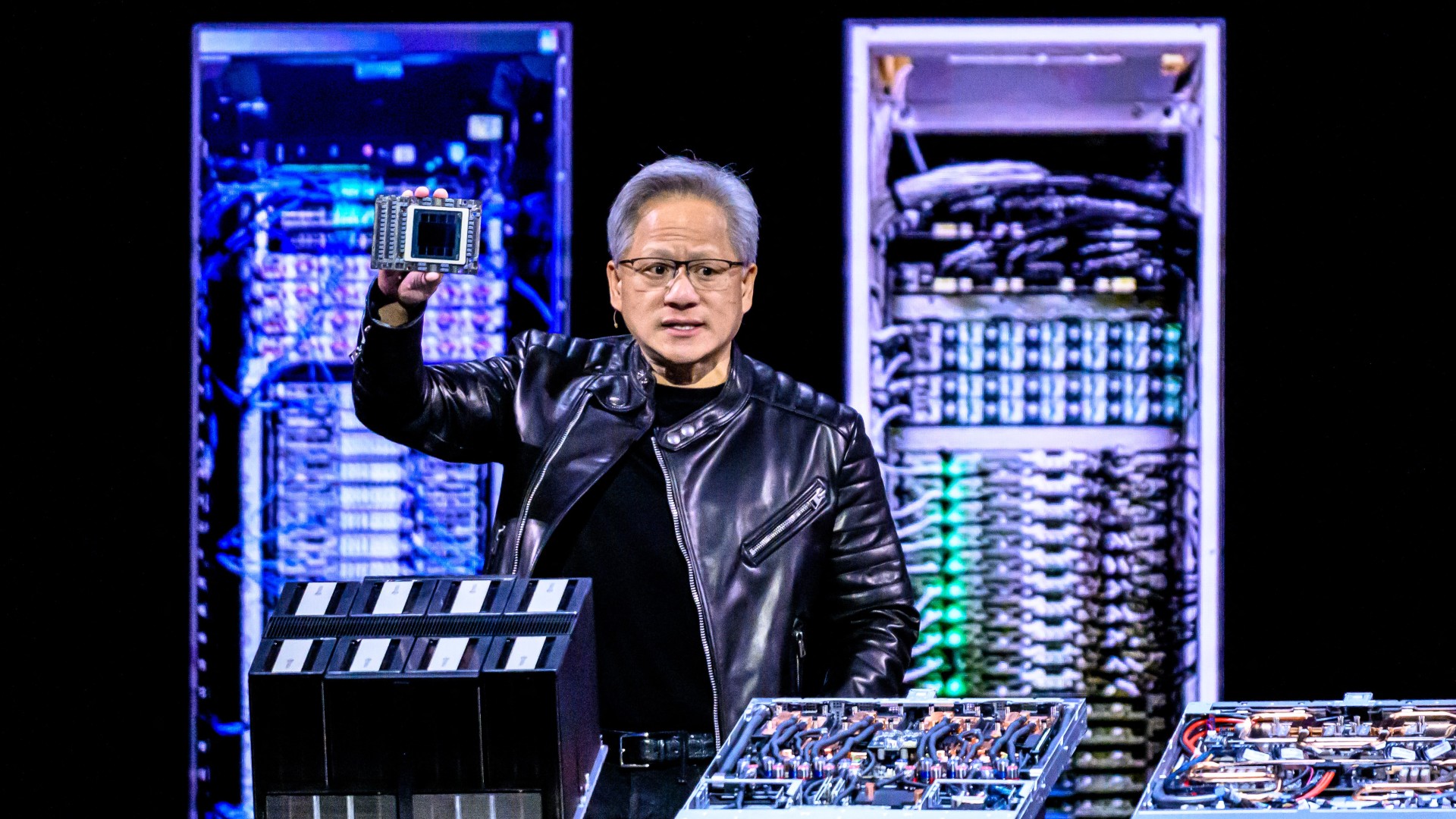

NVIDIA faces major financial blow—stock drops amid tightened AI GPU export rules to China

AI juggernaut NVIDIA is not having a good day. Its stock (NVDA) has dropped nearly 8% to $103.62 due to a $5.5 billion charge, thanks to the US government tightening its GPU export rules to China, as reported by the BBC.

NVIDIA reported in an SEC filing on Tuesday night that, as informed by the government, it would require "special licenses" to sell to Chinese customers for an unspecified period.

The licensing requirement extends to NVIDIA's H20 chips despite an earlier report on April 11th that the Trump administration canceled plans to ban the export of the NVIDIA H20 HGX "Hopper" GPU.

The H20 was explicitly designed to meet the Biden-era export requirements to China by having reduced performance.

As we noted earlier:

"Even though these chips are specifically modified to reduce their performance thus making them legal to sell to China — they are better than many, perhaps most, of China's homegrown chips," said Chris Miller, a semiconductor expert (via NPR).

However, as noted by Business Insider, no licenses for GPU shipments into China have ever been granted, making this requirement more of a ban than a financial disincentive.

The news also follows an earlier report on April 14 that NVIDIA, in what looked like a tit-for-tat move, had agreed to invest $500 billion in AI infrastructure across the United States over the next four years.

Whether this is another negotiation tactic or permanent change remains to be seen, but this news only reinforces the idea that this trade war is chaotic, perhaps by design. — Daniel Rubino

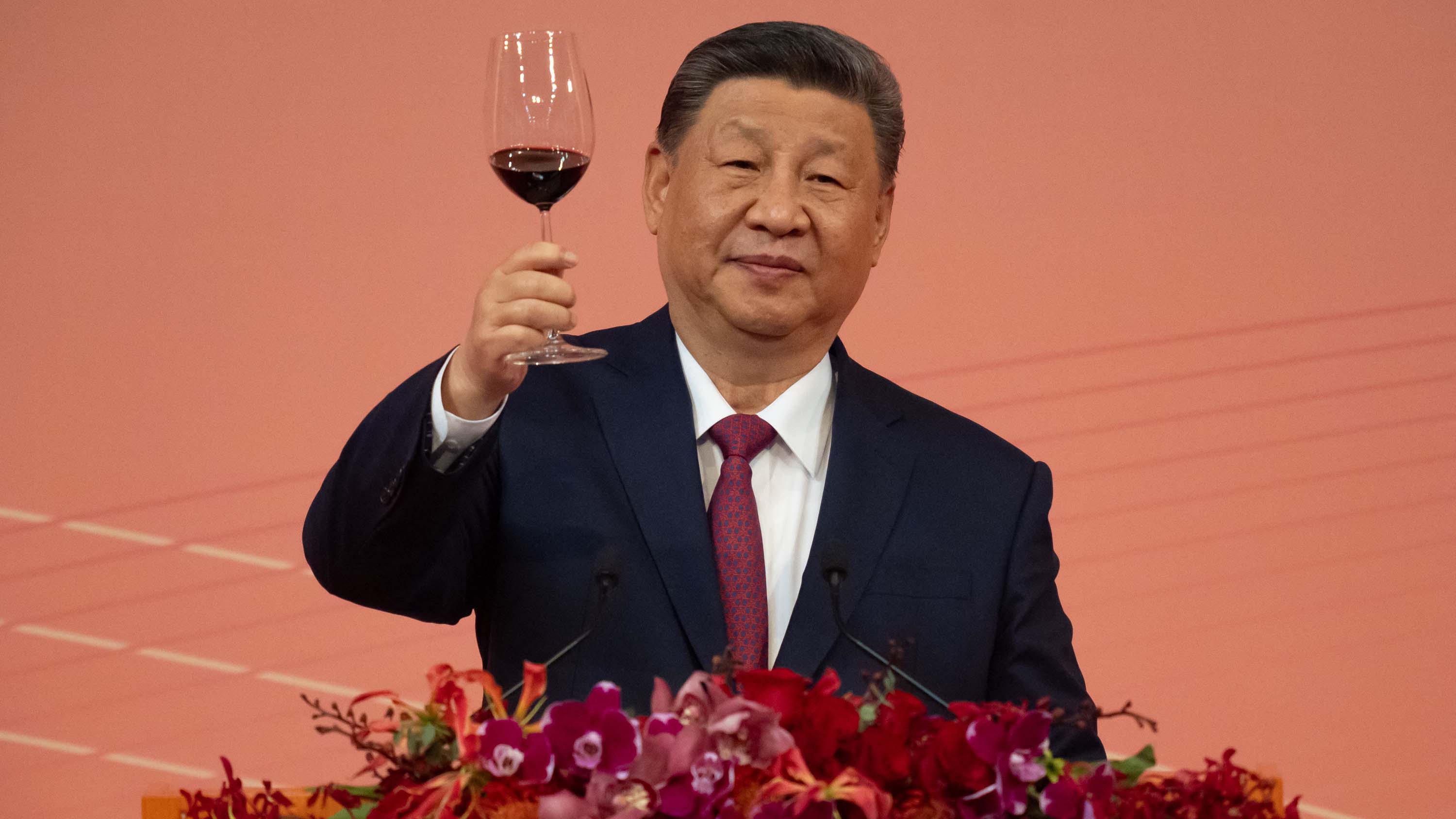

Does China have the upper hand against the US?

The Trump administration's theory on this trade war with China rests on our trade deficit. We export 1/5th of what we import from China to China, making them "the surplus country."

While this is true, it assumes that halting imports from China would have a tangible financial impact on its economy, putting more strain on theirs than ours.

However, the American market "represents only about 14 percent of Chinese exports." So, while it will feel an impact, it's not enough to really cause much harm, as claimed in "Why Xi holds a stronger hand than Trump" just published in the Financial Times.

Adam Posen published a similar argument (and in more detail) in Foreign Affairs earlier this month, noting that "the U.S. economy will suffer enormously in a large-scale trade war with China, which the current levels of Trump-imposed tariffs, at more than 100 percent, surely constitute if left in place."

Who will blink first? Or is this all just a strategy to get China to the table? It remains to be seen, but this trade war will either be the most genius move ever or the worst in history. — Daniel Rubino

China stopped exporting heavy rare earth metals, hitting US industries hard

China has ramped up tensions with the US trade war but not by increasing tariffs again. Instead, the country no longer exports numerous heavy rare earth metals and heavy rare earth magnets to US firms.

According to the NYPost, "access to elements like dysprosium and yttrium are critical to US industry — especially in the tech, electric vehicle, aircraft and defense sectors."

Rare earth metals are routinely used in displays (europium and terbium), speakers (neodymium magnets), hard drives and storage (cerium and lanthanum), and processors (erbium).

China reportedly restricts samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium for this new export ban pending new regulatory approval.

According to the New York Times, "On April 4, the Chinese government ordered restrictions on the export of six heavy rare earth metals, which are refined entirely in China, as well as rare earth magnets, 90 percent of which are produced in China. The metals, and special magnets made with them, can now be shipped out of China only with special export licenses."

Besides consumer technology, electric vehicles (EVs) and defense contractors rely on many heavy rare earth metals for missiles, drones, lasers, robotics, jet engines, and more.

China has long dominated the heavy rare earth metal industry, producing upwards of 99% of the global supply. Their exports are critical for nearly every piece of technology we have.

The New York Times also reports that once China stops dragging its feet on its new regulatory system, it may "take 45 days before export licenses could be issued and exports of rare earth metals and magnets would resume."

However, that new regulatory system could keep US firms permanently on that list.

As of this evening, there is no word on how the Trump administration will respond, but this is a significant escalation of events and one to watch. — Daniel Rubino

BIG MOVE: NVIDIA will produce AI supercomputers entirely within the United States

In another big win for bringing semiconductors to the United States (and increasingly away from China-focused Taiwan), NVIDIA announced it will start making AI supercomputers in the US for the first time.

The tech giant revealed its intention to invest up to $500 billion in AI infrastructure across the United States over the next four years, collaborating with TSMC (Taiwan Semiconductor Manufacturing Company), Foxconn, Wistron, Amkor, and SPIL.

According to NVIDIA, production of NVIDIA Blackwell chips has begun at TSMC's facilities in Phoenix, Arizona.

In Texas, NVIDIA is establishing supercomputer manufacturing plants in partnership with Foxconn in Houston and Wistron in Dallas.

Large-scale production is anticipated within 12 to 15 months.

This news follows Friday's announcement that the Trump administration canceled plans to ban the export of the NVVIDIA H20 HGX "Hopper" GPU (see earlier coverage below).

NVIDIA joins Intel and TSMC in building infrastructure in the US as China is poised to try to take back Taiwan in 2027, upending the world market on chip manufacturing.

TSMC, based in Hsinchu, Taiwan, makes chips for Apple, Qualcomm, AMD, and more. Losing them to a Chinese takeover would be problematic for trade and US national security.

You can read more about NVIDIA's announcement in our full article, "NVIDIA to manufacture AI supercomputers in the U.S. for the first time." — Daniel Rubino

The US stock market, including tech-heavy Nasdaq, is off to a good start despite mixed messaging

While the "exempt" status for electronics like laptops, PCs, and gaming consoles remains in place, the Nasdaq Composite (.IXIC), which is tech-heavy, is at least up 2.10% to 17,076.01. That's still very far from the over 20,000 from December through February.

Likewise, the Dow Jones Industrial Average (DJI) is up 0.98% at 40,608.8, and the S&P 500 (SPX) rose 1.55% to 5,446.42.

So, for now, the markets seem to like the brief window that consumer goods have, at least until the Trump administration clarifies its forthcoming special tariffs for electronic products, including semiconductors (chips, SSDs, RAM) and displays.

Those new tariffs are expected in 30 to 60 days, assuming the US doesn't waiver from its current position or a breakthrough in a trade agreement doesn't happen. — Daniel Rubino

Sony just raised some PlayStation prices — Is Microsoft about to do the same for Xbox?

The cost of a PlayStation 5 "Digital Edition" (disk-free) has risen from £389.99 to £429.99 in the United Kingdom, and from €449.99 to €499.99 for the rest of Europe.

A standard PS5, with its included disk drive, remains the same, while Sony still calls the digital-only price hike a "tough decision" (via The Guardian).

While it apparently avoided explicitly naming the tariffs, references to "fluctuating exchange rates" are relatively clear that they are at least partially responsible for the increased costs.

Console gamers in Australia and New Zealand will seemingly suffer the same fate, as will those in parts of the Middle East and Africa, but Sony's placement in the United States hasn't changed its MSRP for the PS5 (so far).

Microsoft may be headquartered in the US, but a quick check underneath my Xbox Series X sees a familiar "Made in China" marking, so I wouldn't be surprised to see the same price hikes happening to Xbox consoles on my "side of the pond" in England.

Trump already intended to drop tariffs on gaming consoles, but US Commerce Secretary Howard Lutnick confirmed that smartphones, computers, and "other electronics" would get separate tariffs (via Reuters). Where this leaves Xbox isn't crystal clear, as each component inside the consoles can be subject to varying tariff percentages.

We'll keep an eye on Xbox Series S and Series X prices throughout major retailers to see if they creep up. — Ben Wilson

Update: Laptops, PCs, and smartphones will be tariffed in 30 to 60 days, but at a different rate

US consumers are not out of the woods yet. Early Sunday, US Commerce Secretary Howard Lutnick confirmed that smartphones, computers, and other electronics would get separate tariffs.

This seems to be less of a reversal from the late-night Friday "exemption" status for electronics and more of a clarification of what's coming next.

A new tariff will also apply to semiconductors, such as processors, RAM, SSDs, and more.

The Secretary, who appeared on ABC's "This Week," noted that these new tariffs may be imposed in the next 30 to 60 days.

Lutnick went on to state, "We need to have semiconductors, we need to have chips, and we need to have flat panels — we need to have these things made in America."

I guess we can also throw TVs and computer displays into the mix.

Of course, as with everything related to the Trump administration, these new tariffs may never be imposed.

At least for now, consumers should carefully consider their next laptop, PC, or smartphone purchases, as prices could become extremely high by the summer. — Daniel Rubino

Trump turns around on tariffs for PC, gaming hardware, laptops, and more

In a shocking (but welcomed) move, the Trump administration has exempted electronics like laptops, smartphones, and gaming consoles from its hefty 145% tariff on China, offering relief to tech giants like Microsoft and Dell.

The exemptions were found in a late Friday US Customs and Border Protection post.

PCs, laptops, smartphones, gaming consoles, memory, hard drives, and more are now exempt from the 145% tariff on China and the 10% tariff on everyone else.

In short, we shouldn't see consumer prices increase on electronics, but there are some gray areas.

While semiconductors and components remain primarily unaffected, uncertainty around tariffs could still disrupt production and shipping, especially with how chaotic everything has been these last two weeks.

I go into more detail in our new article on this breaking news: "Trump drops tariffs on PCs, laptops, smartphones, and gaming consoles". — Daniel Rubino

Q: Will software and video games be hit with tariffs?

Navigating what is and isn't being hit with tariffs is tricky, and there are few blanket answers.

But at least when it comes to video games, the short answer is no. They won't be hit with extra costs for imports.

For now.

We dive deeper into this question in our new article, "Will software and video games be affected by tariffs?" We discuss unintended ripple effects and how the EU (or any country) could try to impose software taxes, too, to punish the tech-heavy US economy.

MSFT ends week on highnote with 7% stock gain

Rounding out a crazy week, Microsoft (MSFT) is at least doing well, considering all the tariff kerfuffle. The company finished the day up 7 percent and is up 4.05 percent overall for the month (but down 9.23 percent for the year).

As we've discussed before, Microsoft is likely to fare better than other tech companies since so much of its revenue is based on software and services, not hardware like Apple. That said, Apple (APPL) was up 7.73% today, down 13.23% for the month, and up 13.2% for the past year.

Indeed, the overall stock market seems to be ending a bit more positively. The Nasdaq Composite, which caters primarily to tech, was up a modest 2.1%, the S&P 500 rose 1.8%, and the Dow Jones Industrial Average gained 600 points (1.5%).

Of course, we've seen this all before, so what comes next week, especially between the US and China, will be interesting to watch. — Daniel Rubino

Should you buy a Steam Deck, ROG Ally, or even a Nintendo Switch right now?

One of the biggest questions (and the toughest to answer) is whether you should buy imported tech to the US now or wait, which increases your chances of paying more later due to those US-China tariffs.

So what about gaming handhelds? We've already seen some prices increase, e.g., MSI Claw 7+ (+$30 +$100) and Legion Go S with SteamOS (+$50).

And that was before the US announced tariffs on China and jacked them up to 145%!

Indeed, as I wrote this, we learned that MSI had increased the price of the Claw 7+ from $829 to $899. The original price was $799. The same is true for the larger MSI Claw 8 AI+, which has just gone from $899 to $999.

Luckily, our News and Gaming Editor, Rebecca Spear, has a thorough guide on the subject, including current prices for all the major handhelds, such as Steam Deck, ROG Ally, Nintendo Switch, and the best gaming handhelds where they are made, and what else you need to know.

As prices change, we'll update that page regularly, so you may want to bookmark it.

My advice? Look to get one now while there are still supplies in the US. Once Best Buy or Amazon has to import a new batch, we'll likely see some significant price hikes (or those retailers won't even order them, and they'll be 'out of stock').

The other reason is that we're not expecting any major new handheld for at least 3 to 6 months, so it's not like something significant is right around the corner (although the Xbox/ASUS handheld, aka "Project Kennan," could be interesting, but I don't think we'll see that until November for the holiday season, assuming all this tariff stuff is over). — Daniel Rubino

Qualcomm, AMD get pass from China, while Intel, Texas Instruments, and others won't

Semiconductors have a complicated business model. While most PC, laptop, and gaming chips are designed in the US by US companies, such as Intel, AMD, and Qualcomm, most are made (or fabricated) overseas.

Where they are made is now becoming a big deal. China has now clarified how it will treat specific chip makers over others, according to Reuters:

- Intel, Texas Instruments, ADI, and ON Semiconductor are likely to be hit with China's new 125% tariff today, meaning that Chinese companies importing those chips to China will have to pay a significant surcharge.

- Qualcomm and AMD, however, won't face a 125% tariff but will pay whatever is charged to Taiwan, which is undoubtedly much lower, likely in the single digits.

The reason is simple. Intel and others have fabs in the US and may be subject to that higher tariff. Intel also makes many chips in Israel.

Qualcomm and AMD, however, get their chips via Taiwan Semiconductor Manufacturing Company (TSMC), which is based in Taiwan and where most of the world's chips are made and shipped from. Therefore, they are classified differently.

That said, TSMC has a new fab in Phoenix, Arizona, which began high-volume production of 4nm chips in late 2024, comparable to its Taiwan fab. A second fab is on track for 2028 to produce 3nm chips. This game plan is an effort to move critical chip manufacturing away from Taiwan, as China strongly signaled in 2027 that it wants what it claims is its territory.

Intel is also building out fabs in the US for this reason. Indeed, China classifying chips made in Taiwan differently than those made elsewhere, even by US companies, is a not-so-subtle flex on how it views the strategically important island.

Financially, this could bode well for Qualcomm and AMD while punishing Intel. Chinese companies that want to import those chips will pay much more, but they will likely just switch to Qualcomm or AMD if possible.

However, since the Trump administration has not yet carved out exceptions for PCs, laptops, or gaming consoles made in China, this won't affect bottom-line prices and presumable price increases in the coming weeks for those in the US. — Daniel Rubino

China just hit back with a 125% tariff on the US

The trade war between China and the US will only worsen. Beijing increased its tariff from 34% to 84%, and it is now at 125%.

The number seemingly matches that of the US, announced earlier this week and initially reported at 125% for China, but it later came out that it's actually 145% as the US is charging China another 20% due to its lack of cracking down on Fentynal smuggling to the States.

Chinese officials were quoted as saying, "Even if the US continues to impose higher tariffs, it will no longer make economic sense, and it will become a joke in the history of the world economy."

While the numbers being thrown around are indeed a joke in some sense, China knows it is in a precarious situation. It exports five times as much to the US as the US imports to China, making the former the "surplus country" and more vulnerable to import tariffs than the US. If this drags out, it could cause economic instability in China, which may cause political problems for Chinese President Xi Jinping.

Of course, if the US economy went south, it would also cause problems for the Trump administration, though the likelihood of a political revolution in response seems extremely low.

At least for the rest of the world, things are cooling off, even if temporarily, thanks to the 90-day pause in effect so that the US and other countries can ideally hammer out new trade agreements. Were that to happen, it would isolate China on the world stage, increasing even more pressure on the country to come to the table to appease President Trump. — Daniel Rubino

Trump administration canceled plans for export ban on NVVIDIA H20 HGX "Hopper" GPU

NVIDIA, the graphics and AI hardware giant, breathed a sigh of relief after President Trump's administration canceled plans for an export ban placed on its latest H20 HGX "Hopper" GPU.

The enterprise-grade graphics card is restricted by design to meet rules and legal regulations for US hardware exported to China, but still stands as one of the most powerful AI-focused components available for the country to import.

"Even though these chips are specifically modified to reduce their performance thus making them legal to sell to China — they are better than many, perhaps most, of China's homegrown chips," said Chris Miller, a semiconductor expert (via NPR).

The suspension of the ban came after NVIDIA CEO, Jensen Huang, attended a "$1 million a person super PAC dinner" at the Mar-a-Lago resort owned by President Trump, who hosted the event (via CBS).

According to NPR's sources, NVIDIA reportedly "promised the Trump administration new U.S. investments in AI data centers," but it isn't clear if that was the result of a direct conversation between Jensen Huang and President Trump.

Restricting AI hardware exports to China from NVIDIA and other manufacturers has been in place since former President Biden's administration, but the demand for GPUs hasn't slowed down.

Since the success of Chinese AI startup DeepSeek with existing Hopper GPUs, any lifting of this NVIDIA chip export ban has been predicted as "a huge victory" by a former OpenAI board member.

While the title of world's most profitable company continues to be a fight between US-based Apple and Microsoft, third place is still held by NVIDIA (via companiesmarketcap.com) with a significant lead ahead of Amazon. — Ben Wilson

Wedbush Securities cuts Microsoft’s price target, Apple faces trouble

Due to Microsoft's downturn in stock performance, which is currently at -3.62 % (MSFT), Wedbush Securities has cut its price target from $550 to $475 and lowered earnings forecasts for the rest of the fiscal year.

The target price cut is based on uncertainty in the tariff "poker game" and risks from Chinese supply chains.

That said, Wedbush maintains an 'Outperform' rating for Microsoft, even if earnings are likely to be tumultuous when reported on April 30th.

Microsoft is somewhat immune to Chinese retaliatory tariffs because most of its profit comes from software services like Azure, AI, Microsoft 365, and Windows, all of which are exempt from the import tax.

Microsoft does have its Xbox consoles, such as the Xbox Series S and Xbox Series X. As our Executive Editor Jez Corden noted earlier this morning, "While Microsoft does produce some hardware in Mexico, the vast majority comes out of China," which now faces a 125% 145% import tariff to the US.

Likewise, Microsoft has its Surface line of laptops, which are also coming out of China. Indeed, as we exclusively reported, Microsoft is expected to launch new, smaller, and more affordable Surface Pro and Surface Laptop devices in May. Microsoft may still proceed with the launch as it likely stockpiled enough devices for an initial launch. The same may be true of Xbox consoles, although if the trade war with China goes on for many months, eventually, US-based supplies will run out.

Despite Microsoft's potential woes, it is faring better than Apple, which is currently down 10% (APPL). Over half of Apple's revenue reportedly comes from iPhone sales, and since many of those are made in China, this could significantly impact its ability to reach expected earnings. Just today, it was reported that Apple is chartering "cargo flights to ferry 600 tons of iPhones, or as many as 1.5 million, to the United States from India" to beat tariffs from China.

However, the long-term outlook for Apple is grim unless China and the US come to a new agreement, as shifting production elsewhere, including the US, could take years. An earlier report claimed iPhones could cost up to $3,500 someday. — Daniel Rubino

Tech stocks take a tumble after rally

Despite the 90-day relief afforded to all countries (except China) on draconian tariff increases, the stock market is not responding well, even after yesterday's massive rally, which saw the third-biggest gain in post-WWII history.

As of 1:30 PM ET, the tech-heavy Nasdaq Composite was down 5%, far from its February 2025 high of 20,204, which preceded the tariff announcement. It's currently trading at 16,280.

The S&P 500 was down 4.4%, and the Dow Jones Industrial Average was down 1,500.

The U.S. 10-year Treasury bonds started to recover from April 2, although they're still negative and far from their January 10th high.

In more specific tech, Microsoft (MSFT) is down 4%, Alphabet (GOOG) is down 5%, NVIDIA (NVDA) is down 7%, and Apple (AAPL) is down a massive 11.5%. Intel (INTC), Qualcomm, and AMD (AMD) are down 1.8%, 9.5%, and 9%, respectively.

It's clear the markets are reacting to uncertainty, which is something abhorred by stock traders. — Daniel Rubino

European Union pauses planned US counter-tariffs

In response to the US putting its tariff increase on hold for 90 days so a reported 70+ countries can hammer out a new trade agreement, European Commission President Ursula von der Leyen said the EU would not go forward with counter-tariffs on US goods for at least 90 days.

Earlier reports before the pause indicated that members of the EU were threatening tariffs on US tech companies and online services. Such a move would ratchet up the trade war, as currently, most tariffs only hit physical goods, not digital products.

Turning to the UK, which is no longer in the EU, previous reports have been fraught as the US requested that the UK government sell access to the NHS (National Health Service), which governs their universal healthcare system.

The UK had put up its forthcoming tech tax and online safety laws to appease the US, which would have affected Meta, Alphabet, Microsoft, and X with recuring costs. — Daniel Rubino

US tariffs on Chinese imports are at least 145%, not 125%

As if to make matters worse, the oft-reported 125% retaliatory tariff placed on China by the Trump administration was lowballing it as the White House clarified on Thursday that it's "at least 145%," according to Yahoo Finance, who first reported the news.

Chinese Foreign Ministry spokesperson Lin Jian also accused the United States of using "tariffs as a weapon to exert maximum pressure and seek selfish gains".

The statement came in response to President Trump’s decision to escalate the tariff rate on Chinese goods, intensifying the already fraught trade tensions between the two nations. — Daniel Rubino

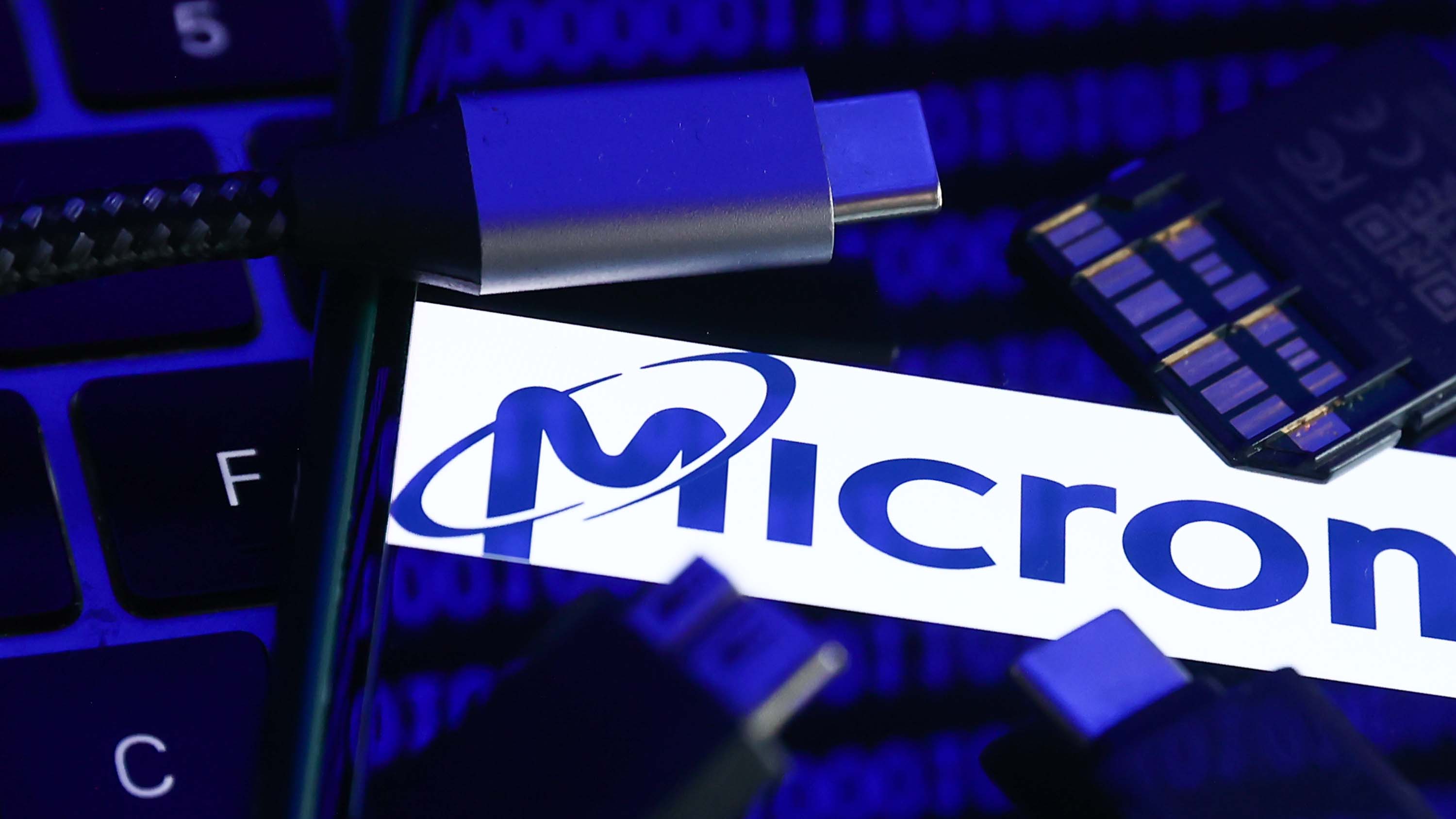

Micron to jack up prices: SSDs and memory modules for consumer goods will be hit

Although this news came out earlier before the China-US-China-US tit-for-tat tariff rally, Micron, who makes memory modules including solid-state drives (SSDs) for everything from cars to, you guessed it, laptops/PCs/gaming devices, informed its customers it was planning to "impose a surcharge" on "some products."

As Reuters noted, who broke the story, while semiconductors are technically exempt from the tariffs, that category only applies to some of its portfolio, with memory modules and solid-state drives (SSDs) subject to the new import tax.

Trump's tariffs directly affect Micron's manufacturing as it has plants in China, Taiwan, Japan, Malaysia, and Singapore.

The last four should be knocked down to 10% for the next 90 days while the countries "have talks," but China is at a 125% tariff rate, which is insane.

Since the US-China tariffs are still in place (and went into effect today), Micron is assumed to continue with the surcharges until otherwise stated.

This will add a few more dollars to the increasing overall cost of importing PCs, laptops, and gaming devices (handhelds, consoles) to the US and have residual effects elsewhere, including data centers, smartphones, Smart TVs, home automation, and VR/AR devices. — Daniel Rubino

Trump comments on TSMC, tariffs, and building a fab in the US

Earlier this week, President Trump claimed he spoke to TSMC (Taiwan Semiconductor Manufacturing Company). The foundry is responsible for mass-producing processors used in a massive range of consumer devices, including those featuring Intel's latest 200V (Lunar Lake) chips.

Reuters highlighted Trump's comments, delivered at a Republican event:

"TSMC, I gave them no money, great company. Most powerful in the world, biggest chip company in the world. They're spending $200 billion in Arizona building one of the biggest plants in the world, and that's without money."

The company aims to expand to at least three fabrication plants in Arizona, with a larger plan for five factories in the US. Trump detailed his apparent terms for TSMC:

"If you don't build your plant here, you're gonna pay a big tax, 25 maybe 50 maybe 75 maybe a hundred percent."

TSMC reportedly declined to comment after Reuters reached out.

Taiwan is included in the 90-day pause, after being hit with a 32% tariff and recovering from a devastating downturn it triggered in the country's stock market. — Ben Wilson

Don't expect Xbox to escape tariffs on China

I've seen some comments online that Xbox might escape higher tariffs because they manufacture Xbox consoles in Mexico, rather than China or Vietnam which have been targeted to pay higher rates. I can confirm that this isn't the case.

While Microsoft does produce some hardware in Mexico, the vast majority comes out of China. As of writing, U.S. President Trump has issued a 90 day stay on the higher tariffs on most countries, but wants to impose a 125% tariff on any products coming out of China. This would impact Xbox, PlayStation, and various other tech manufacturers like Apple incredibly hard.

I've seen some at least vague evidence that Microsoft may have been stockpiling Xbox hardware in the United States ahead of this situation last year. It could be why users in other regions such as Europe and the Middle East have seen Xbox stock fluctuations more so than might be typical. That's largely speculative for now. But it's fair to expect that Microsoft, like other major U.S. tech companies, are all-hands to assess the impact of Trump's trade war. — Jez Corden

90-day pause: Everyone except China gets a break for talks

In addition to raising the extreme tariff on China to 125% (effective immediately), President Trump announced a 90-day pause on tariffs, dropping them to just 10% for all countries that have reached out to renegotiate trade agreements with the US.

According to Trump, “more than 75 Countries” want to have talks to suspend or re-litigate the tariff increases due to the impending harm they would have on many economies.

The markets have responded approvingly: The S&P 500 Index is up more than 7%, the NASDAQ Composite is up 10%, and the Dow Jones Industrial Average is up nearly 7%.

Trump raises the stakes: Increases tariff on China to 125%

Not waiting long after China announced a retaliatory tariff on the US, knocking it up to 84%, President Trump hit back with a 125% increase on China.

According to Trump, the changes are “effective immediately” due to China's “lack of respect for the World’s Markets. "

Whether China will respond with another tariff increase or decide to talk to the US to negotiate a new deal remains to be seen, but neither country is backing down.

China slaps 84% retaliatory tariffs on US

China has fired back at U.S. President Donald Trump’s aggressive tariff strategy, escalating the trade war with a sharp increase in levies on American imports, as reported by the AP.

Starting April 10, tariffs on U.S. goods entering China will jump from 34% to 84%.

This move directly responds to the U.S. raising tariffs on Chinese goods to over 100% as of midnight.

China has previously noted it won't be "blackmailed" into complying with US demands and is pushing back hard. However, as some in the Trump administration have noted, China exports to the US nearly five times what the US exports to China, meaning any retaliatory tariffs will hit China harder than the US.

Current thinking theorizes that if China's economy were to weaken sharply, it would weaken the grip of Chinese President Xi Jinping, potentially leading to civil unrest.