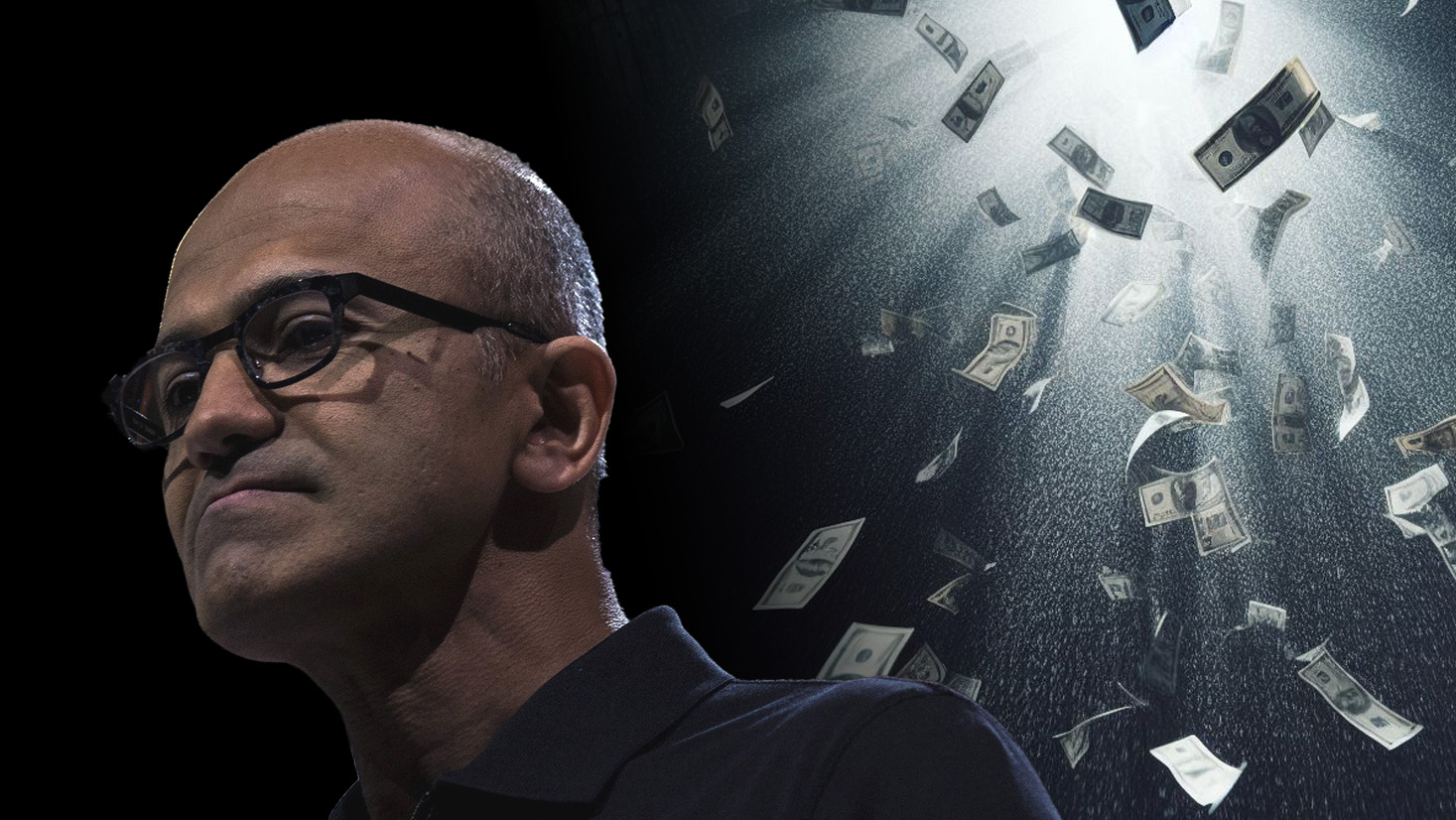

The IRS just dropped approximately $29 billion in back taxes on Microsoft. Oops.

The disputed fees are the result of an audit spanning 2004 through 2013.

All the latest news, reviews, and guides for Windows and Xbox diehards.

You are now subscribed

Your newsletter sign-up was successful

What you need to know

- Microsoft has been under tax audit by the Internal Revenue Service for nearly a decade.

- The IRS audit has proposed that Microsoft is liable for $29 billion in back taxes, in addition to the $10 billion the corporation had already paid.

- Microsoft disagrees with the IRS's proposed adjustment and plans to appeal, though it would take several years for a court to make a final decision in the case.

The US Internal Revenue Service (IRS) has sent Microsoft Notices of Proposed Adjustment as a result of the federal agency's ongoing tax audit of the company. Microsoft issued a statement regarding the proposed adjustments and declaring its intentions to contest the notices.

Daniel Goff, Microsoft's Corporate Vice President of Worldwide Tax and Customs, penned the blog post from the company, providing a background explainer on the IRS audit. According to Microsoft, the company has been working with the IRS regarding the agency's concerns over how the company had allocated income and expenses for tax years ranging from 2004 through 2013.

Last chance deals in the final hours of Prime Day

- Razer Wolverine V2 Chroma | was

$149.99now $87.99 at Amazon - Seagate Xbox Expansion Card 1TB | was

$219.99now $149.99 at Amazon - LG C3 65" 4K OLED TV | was

$2,499now $1,696.99 at Amazon - Microsoft Surface Pro 9 | was

$2,599.99now $1,799 at Amazon - Immortals Fenyx Rising (Xbox) | was

$29.99now $10.49 at Best Buy - Samsung Galaxy Buds Pro 2 | was

$229.99now $120 at Amazon - Razer Kishi V2 Cloud Controller | was

$99.99now $79.99 at Amazon

With the IRS having issued Notices of Proposed Adjustment to Microsoft, the auditing period of the investigation is expected to come to a close. It will now be up to Microsoft and the IRS to agree to a process to resolve the $29 billion in back taxes Microsoft owes the federal government, along with all due penalties and interest.

Microsoft was required to pay a tax bill of $10 billion previously as a result of the Tax Cuts and Jobs Act, and the statement from Goff indicates that Microsoft believes this payment should decrease the final bill from the IRS. The IRS, however, did not include the $10 billion payment in its Notices and has seemingly taken the position that the payment is not relevant to the $28.9 billion in new charges.

According to Goff, Microsoft has undergone changes to its corporate structure and practices since the back taxes were accrued that would prevent any further issues with the IRS. Microsoft's statement proclaims the company has been and will continue to be compliant in working with the IRS to come to a resolution regarding the back taxes. However, Microsoft has also alluded to its willingness to contest the IRS via the IRS Appeals division process and through the judiciary system. The process could ultimately take several years to reach a resolution.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Cole is the resident Call of Duty know-it-all and indie game enthusiast for Windows Central. She's a lifelong artist with two decades of experience in digital painting, and she will happily talk your ear off about budget pen displays.