FY22 Q1: Microsoft Surface rev drops 17%, while Windows is up 10% with ongoing chip shortage

What you need to know

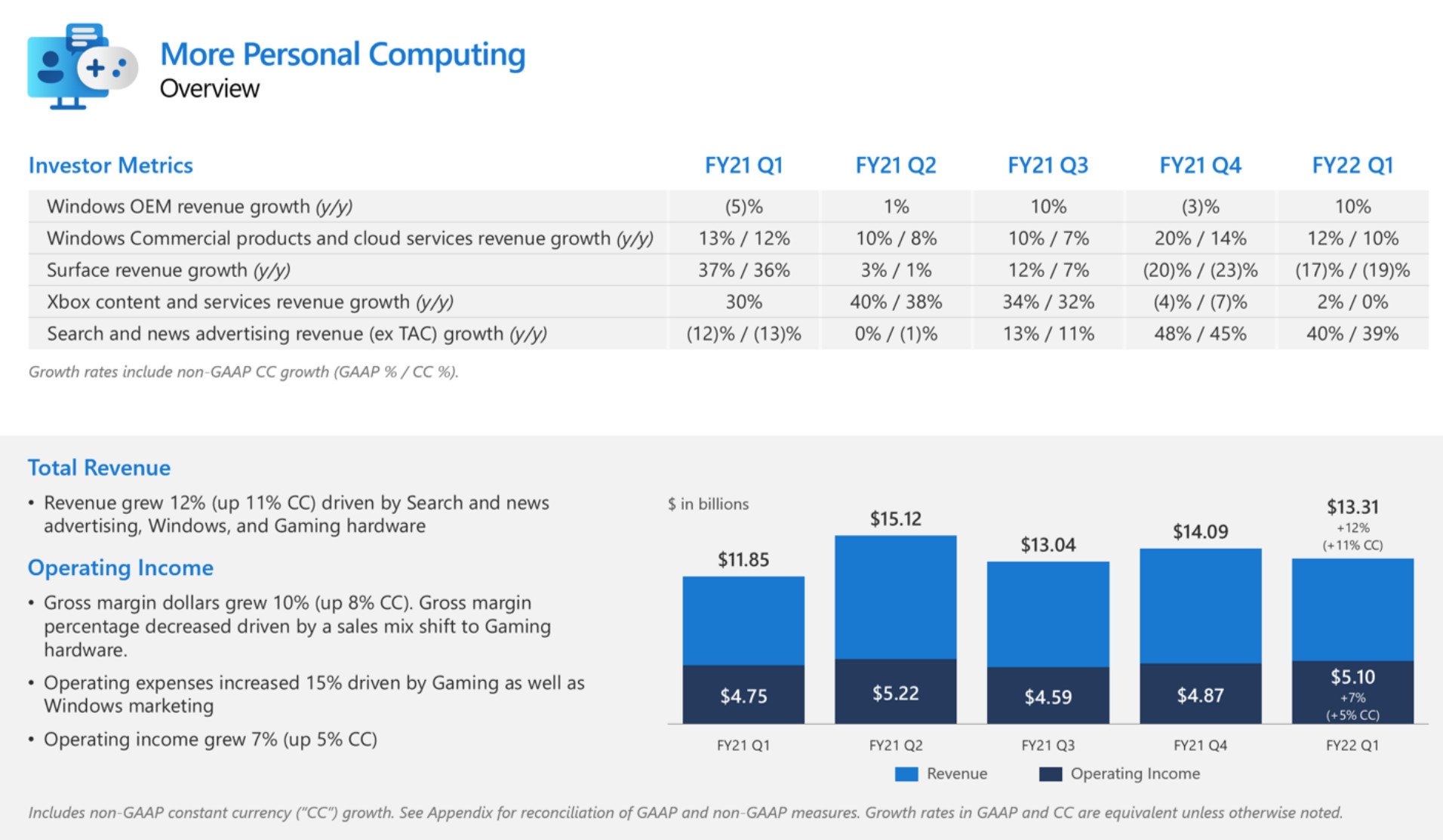

- Microsoft's More Personal Computing division is up 12% YoY.

- Surface revenue dropped 17% due to chip shortages.

- Revenue from Windows OEM licenses was up 10%.

- Search and news advertising revenue grew 40% with "improved customer advertising spend."

Update: Microsoft remarked during the investor call that next quarter wouldn't be better for Surface with a "single-digit decline" in revenue calling out the impact on premium devices due to ongoing supply chain issues. Overall rev for More Personal Computing should be between $16.35 and 16.75 billion, with Windows OEM license rev growing "low to mid-teens." Xbox hardware rev should grow in the "high single digits" despite "supply chain uncertainty" with growth in the mid-teens for Xbox services with strong holiday engagement.

Microsoft has published its FY22 Q1 numbers hitting $45.3 billion in overall revenue and (again) beating expectations of between $43 and $44 billion.

The More Personal Computing division's results were mostly very positive, with overall revenue at $13.3 billion and up 12% year-over-year. Here's how it breaks down.

- Windows OEM revenue increased 10%

- Windows Commercial products and cloud services revenue increased 12% (up 10% in constant currency)

- Xbox content and services revenue increased 2% (relatively unchanged in constant currency)

- Search and news advertising revenue excluding traffic acquisition costs increased 40% (up 39% in constant currency)

- Surface revenue decreased 17% (down 19% in constant currency)

The one sore spot is Surface revenue, which had a sharp decline of 17% compared to last year. However, this was expected as during the FY21 Q4 earnings call Microsoft gave guidance noting it expected "reduced revenue in the low teens." However, 17% is the high teens, suggesting the impact due to ongoing supply chain issues was more significant than anticipated.

Incidentally, Microsoft stopped reporting actual Surface revenue in dollar amounts. Instead, it is only revealing percent changes in Surface income.

Microsoft is in a precarious position for component supply for its Surface business. It only makes small chip orders through Intel and AMD putting it at the bottom of the list compared to the big three (Lenovo, Dell, and HP), prioritizing bulk orders with larger contracts.

While Microsoft just launched Surface Pro 8, Surface Laptop Studio, Surface Go 3, and Surface Duo 2, those were only a few weeks ago with limited supply in a very narrow set of markets, suggesting these numbers are primarily about existing (and older) Surface products.

Get the Windows Central Newsletter

All the latest news, reviews, and guides for Windows and Xbox diehards.

Windows OEM rev is "better than expected," although even there, Microsoft observes, "continued PC demand impacted by supply chain constraints." That translates to it could have sold even more licenses to its OEM partners if those partners didn't have their own issues producing and shipping new laptops and PCs. Microsoft CEO Satya Nadella notes there has been a "structural shift in PC demand" due to the pandemic. Microsoft CFO Amy Hood remarked that Windows OEM revenue was "stronger than expected" due to commericial interest with higher rev per Windows license.

It is also worth noting that search and news advertising related to Bing and MSN.com had its revenue grow by 40%, which is another good sign that MSN and Bing are doing quite well for the company.

Finally, Microsoft Xbox FY22 Q1 revenue also went up 16% citing Xbox Series X|S and Game Pass.

Daniel Rubino is the Editor-in-chief of Windows Central. He is also the head reviewer, podcast co-host, and analyst. He has been covering Microsoft since 2007 when this site was called WMExperts (and later Windows Phone Central). His interests include Windows, laptops, next-gen computing, and wearable tech. He has reviewed laptops for over 10 years and is particularly fond of 2-in-1 convertibles, Arm64 processors, new form factors, and thin-and-light PCs. Before all this tech stuff, he worked on a Ph.D. in linguistics, performed polysomnographs in NYC, and was a motion-picture operator for 17 years.