Microsoft Surface and consumer Windows Q4 rev surge due to strong remote work demand

Microsoft's Surface and consumer Windows revenue are up sharply due to increased demand from the COVID pandemic

What you need to know

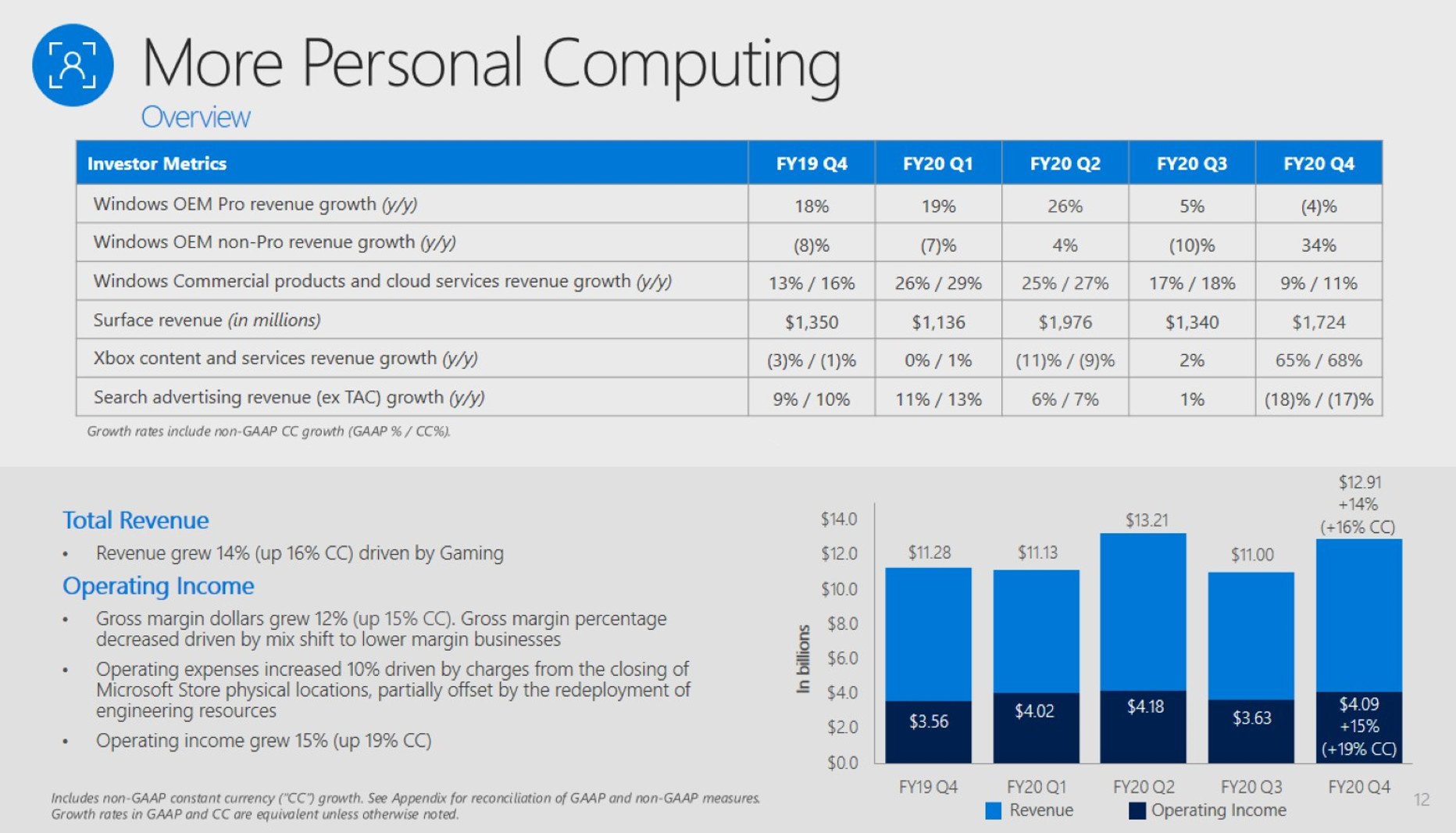

- Surface revenue is up 28 percent (year over year).

- Microsoft pulled in $1.74 billion in Surface revenue, up from $1.3 billion last quarter.

- Windows non-Pro licenses saw a massive 34 percent jump.

- Microsoft beat overal Wall Street expectations, again.

Update: Microsoft expects another big quarter (Q1 FY2021) for More Personal Computing (Windows, Xbox, Surface) with guidance revenue between $10.95 billion and $11.35 billion. More specifically, double-digit growth in Windows commercial; mid-teen growth, "solid demand" for Surface hardware; high teen growth for gaming.

Microsoft reported 2020 fiscal year quarter four (FY2020 Q4) results today with healthy revenue growth mostly driven by a surge in work-from-home scenarios and education-related needs.

Surface revenue is up 28 percent ($1.74 billion) compared to the same time last year ($1.35 billion), and up from the previous quarter's $1.34 billion. The increase in sales is still just below Microsoft's prior record of $1.92 billion due to the holiday shopping season.

In the last quarter, Microsoft released multiple new devices, including Surface Go 2, Surface Book 3, Surface Earbuds, and Surface Headphones 2.

Microsoft recently announced a refocus of its forthcoming Windows 10X operating system to go to single-screen devices first instead of planned dual-screen ones. The explanation given was the rapidly changing environment of Microsoft's customers, and the company wanting to meet that demand. That decision becomes more clear once this quarter's revenue is taken into consideration.

Windows OEM revenue saw a dip in Pro licenses – down 4 percent – due to weakness in small business demand, likely driven by many companies still operating at reduced staff, or not being able to open at full capacity.

However, the surprising news relates to Windows non-Pro licenses, which saw a massive 34 percent jump driven by high consumer demand. Microsoft cites "remote work and learn scenarios" as the primary driving factors for the sharp rise in Windows sales to OEMs. For context, Microsoft projected low single-digit growth for Windows OEM revenue.

Get the Windows Central Newsletter

All the latest news, reviews, and guides for Windows and Xbox diehards.

Overall, Microsoft beat Wall Street estimates with a total of $38 billion instead of the projected $36.54 billion by financial analysts. This beating of expectations is a continued and welcome trend with Microsoft, further driving up its surging stock price.

Daniel Rubino is the Editor-in-chief of Windows Central. He is also the head reviewer, podcast co-host, and analyst. He has been covering Microsoft since 2007 when this site was called WMExperts (and later Windows Phone Central). His interests include Windows, laptops, next-gen computing, and wearable tech. He has reviewed laptops for over 10 years and is particularly fond of 2-in-1 convertibles, Arm64 processors, new form factors, and thin-and-light PCs. Before all this tech stuff, he worked on a Ph.D. in linguistics, performed polysomnographs in NYC, and was a motion-picture operator for 17 years.