Microsoft and the duo user Part V: The 13 companies building Windows 10 phones

Back in 2006 Microsoft enjoyed double-digit market share as the leader in the smartphone space. In 2016 the company is barely scraping by with 1% of the market to boast as its own.

Before smartphones became the personal computer of choice in the consumer space beginning in 2007 with the advent of the iPhone, Microsoft and its partners maintained a respectable presence in the market. It was a niche space of business users and geeks (sorry, enthusiasts), but partners such as HTC helped Microsoft enjoy a position of power among those who wanted more PC-like functionality from their mobile phones.

When the iPhone hit the market, it found the sweet spot between functionality and ease of use and was hit for consumers. The iPhone and Android devices that followed and employed an iPhone-like touch UI were a hit. Consequently, Microsoft's dominance in the smartphone space took a hit from which it has never recovered. Like Jesus' disciples scattered when Judas and others came to retrieve him from the Garden of Gethsemane, Microsoft's phone partners began scattering in support of Android after Apple changed the game.

The struggle is real

Despite attempts to claw its way back from the abyss of consumer rejection, with disruptive "reboots" and "revisions of its mobile OS, few OEM partners ([despite 25 partners launching phones in 31 countries](http:// /microsoft-reveals-coship-mobile-new-windows-phone-oem)) responded with the embrace of the platform Microsoft needed. Nokia, of course, was the exception.

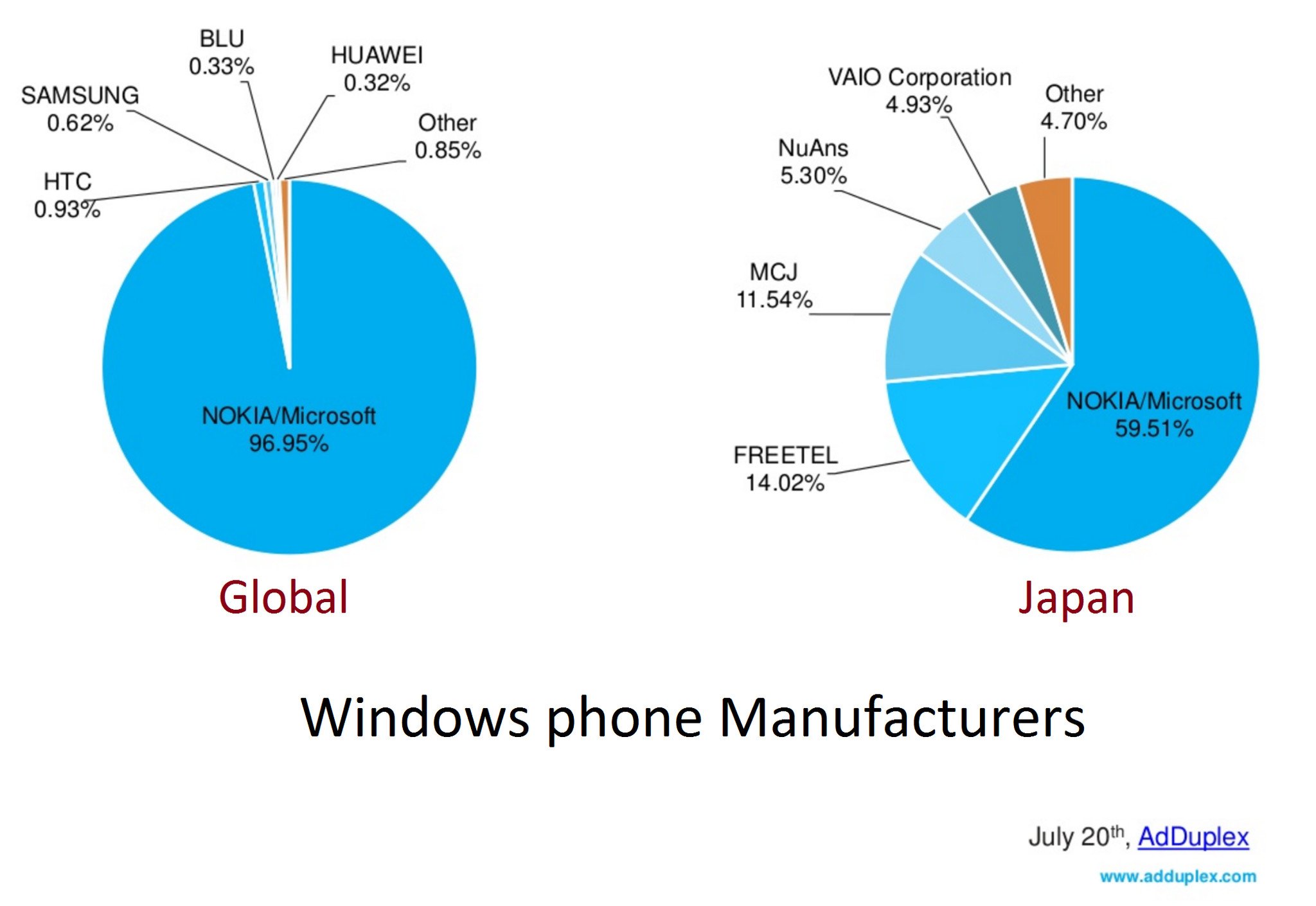

The partnership between Nokia and Microsoft became, what many would describe as an unhealthy co-dependency. That Nokia produced more than 95% of Windows Phones rested uncomfortably with many. The success or failure of both was equally intertwined. Microsoft's purchase of what was effectively "the entirety of the Windows phone business" in 2013 was seen as an opportunity to bring manufacturing in-house and create a greater hardware and software synergy to increase development and speed to market. Things didn't work out as planned. Criticisms of the purchase aside, had Nokia fallen into the hands of another buyer, Microsoft's mobile phone fate may have been even worse.

Manufacturing partners saw little opportunity for success in a market dominated by Lumia.

Before the much publicized Microsoft write down of the Nokia purchase there was another negative variable that presented itself. With nearly 100% of Windows Phones in the market being Nokia/Microsoft devices (and the preferred brand by most users) Windows Phone had begun being seen as synonymous with Lumia and Lumia with Windows Phone. This view was a disastrous perception problem for the platform and potential partners who Microsoft desperately needed to invest in it. HTC with the 8X/8S and other potential partners simply didn't stand a chance.

Manufacturing partners saw little opportunity for success in a market dominated by what had become first-party hardware. This conundrum was further enhanced by the enduring limitations to modifying the Windows Phone software which would allow OEMs to differentiate their phones from competitors as they could do with Android.

A friend in need (or just the two of us)

So now, in 2016, with the Nokia purchase effectively a bust and Redmond's attempts to control all aspects of its phone business through the acquisition of Nokia's Phone division having scared many partners off, Microsoft has been left with few "friends" of its mobile platform. Yet, as in life, everybody needs a friend. Especially when you're hovering around 1% market share, you have lofty ambitions of success for the mobile component of your unified platform, your rivals are eating your lunch and smartphone consumers are asking "what's a Windows phone?"

All the latest news, reviews, and guides for Windows and Xbox diehards.

That said, the Universal Windows Platform is here. There is now effectively one Windows on all form factors. Windows 10 is not just another mobile OS contending with rivals based on the old "mobile platform vs. mobile platform" rules. Windows 10 Mobile is a component of a single unified platform with a shared core and it benefits from the synergy of the entire platform and the devices it supports. One may be inclined to view Windows 10 Mobile as just another reboot of the mobile OS. That would be an error. It is part of a precedent-setting industry first, as a single portion of Microsoft's Unified Windows Platform. And though success is by no means guaranteed, Microsoft has changed the game with Windows 10, the shared Core, the UWP and Continuum. Things are different now.

Success is by no means guaranteed, but Microsoft has changed the game.

And make no mistake, phone manufacturers and PC OEMs alike have taken notice. The iteraton-focused smartphone model is leading to a dead end as manufacturers find it harder to differentiate their high-end phone hardware from rivals. The PC market's loss of ground to personal computing devices such as smartphones and tablets has also put PC OEMs in a difficult position.

An ultra-mobile PC or Continuum-powered Windows 10 Mobile phone device is a natural solution to a declining PC market and natural evolution to the plateauing smartphone market. A device that physically rides the line between phone and PC and is supported by a unified platform of software, services and a leading cloud computing platform presents a unique investment opportunity to both phone and PC manufacturers.

In a smartphone industry dominated by Android, where making a profit is difficult even for OEMs such as Samsung, many manufacturers have begun to look beyond the saturated Android option. Windows 10 Mobile and Continuum-enabled phones are a unique, forward-looking solution that addresses the challenges PC and phone manufacturers are facing. It is also a "less competitive" investment than Android given the comparatively fewer partners who have embraced the platform. And for OEMs who only want to diversify their portfolio, while continuing investments in Android, it is a sound option. Even if they wish to reuse hardware used for an Android device.

Who's on board

So given Microsoft's plight as well as their innovation and competitive advantage, where does the company stand with partnerships? This is a critical question. Microsoft has, as part of its retrenchment strategy and move to a Surface model, backed away from being a phone manufacturer and moved out of some critical markets. If Microsoft is going to succeed, as it did in the PC space over the past decades, (and as Google replicated with Android) partners are key. So who's on board? Let's take a look.

Back in 2015, Microsoft announced 25 partners around the world. The infographic below gives an idea of the distribution of Windows phone based on OEM support at the time.

Since that 2015 announcement many of those OEMs, to my knowledge, have not launched a new Windows 10 Mobile device. Below we will look at 13 partners who have recently launched or will be launching Windows 10 Mobile phones in the near future. As some of these manufacturers have or will be launching multiple phones Microsoft is represented with at least 17 Windows 10 Mobile phones between these 13 OEMs in addition to the current Lumia's in the market.

| Rank | OEM | Windows 10 Mobile phone | Continuum | Company Location |

|---|---|---|---|---|

| 1 | Acer | Liquid Jade Primo | Yes | Taiwan |

| 2 | Alcatel | Fierce XL | No | China |

| 3 | Alcatel | Idol Pro 4 | Yes | China |

| 4 | Coship | Moly X1 | No | China |

| 5 | Coship | Moly PcPhone W6 | Yes | China |

| 6 | Covia | Breeze X5 | No | Japan |

| 7 | Cube | Name not yet known | Yes | China |

| 8 | Freetel | Katana 01 | No | Japan |

| 9 | Freetel | Katana 02 | No | Japan |

| 10 | Funker | 5.5 Pro | No | Spain |

| 11 | Funker | 6.0 Pro 2 | Yes | Spain |

| 12 | HP | Elite x3 | Yes | US |

| 13 | Lenovo | Softbank 503 LV | No | China |

| 14 | Mouse | Madosma | No | Japan |

| 15 | Nuans | Neo | Yes | Japan |

| 16 | Vaio | Phone Biz | Yes | Japan |

| 17 | Yamada | Every Phone | No | Japan |

Analysis

As we can see the claim made by some that Microsoft has no manufacturing partners supporting the Windows 10 Mobile platform are clearly false. Moreover, of the thirteen OEMs we've identified here, there are a total of seventeen phones, eight of which support Continuum. Of course, one of the immediate criticisms presented when OEM partners are identified is that these are "no name manufactures." The assumption is that their contributions to the platform are negligible.

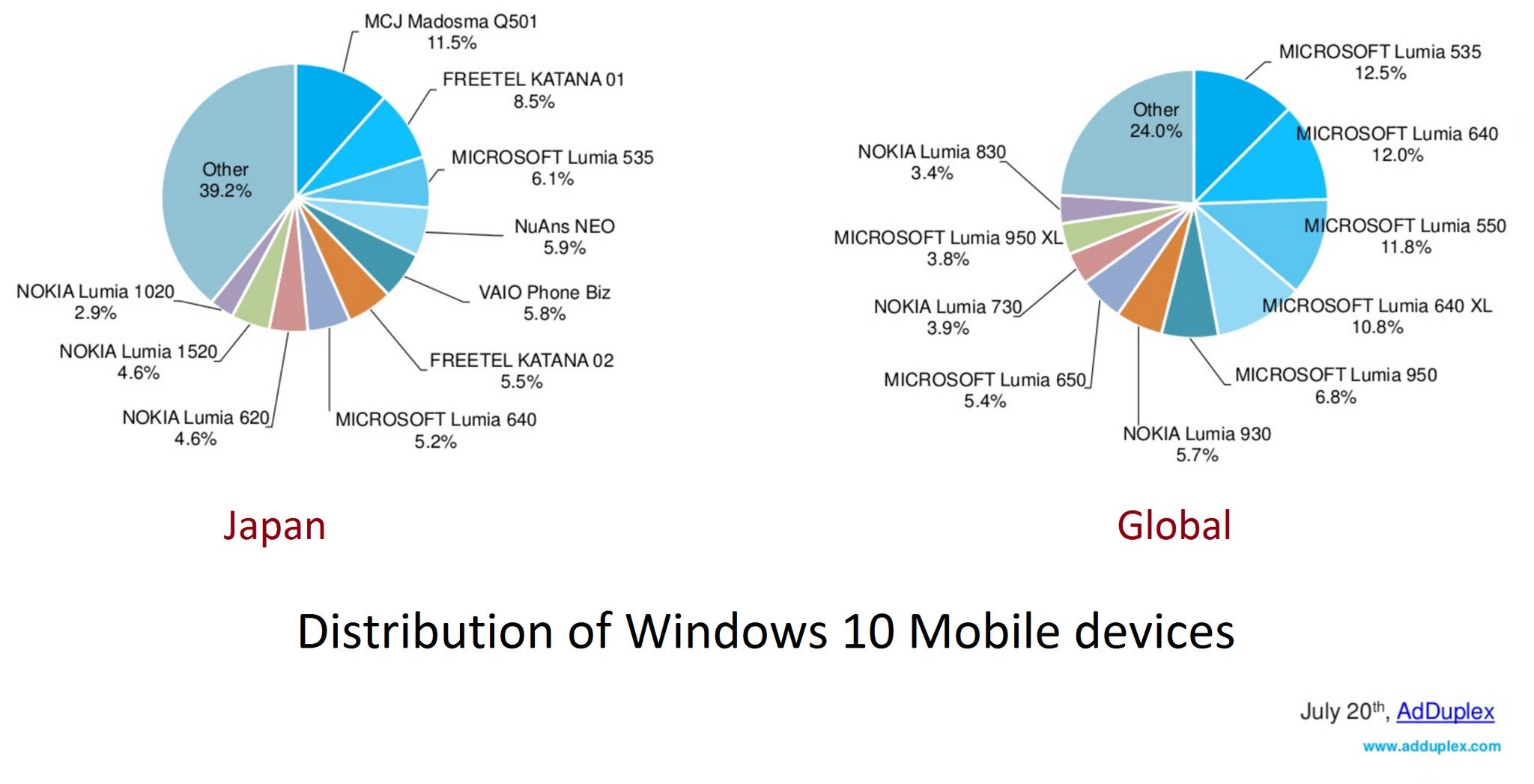

One thing to remember, however, is that though some of these OEMs may not have global reach, they do have influence within the regions they serve. Our own Daniel Rubino made this point clear regarding the performance of local Windows phone manufacturers in Japan when contrasted against the presence of first-party Lumia devices in the same region. As seen in the table from the recent Ad Duplex report the influence of Japanese OEMs in their region is a positive outcome of support from local, and sometimes overlooked manufacturers.

Of course, we'd love to see the likes of Samsung place the full weight of its brand, advertising power, carrier influence and global reach behind Windows phone. However, the collective positive impact of local manufacturers, who know and are known by their regions, like those in Japan, can be a key benefit to the partnerships Microsoft forges with these lesser known OEMs.

It is certain that Microsoft's goal is that local smartphone manufacturers will be strong representatives of the Windows 10 Mobile platform, even at the cost of a diminished regional presence of first-party devices. As we've stressed in the past, Microsoft's 1.5 billion PC install base presence was achieved through partnerships.

Though many Windows phone enthusiasts have grown to prefer first-party devices and sometimes sees them as synonymous with the platform, the bigger picture is one of partnerships. If Microsoft achieves its goal, there will be more partner devices in the market than first-party devices. Furthermore, much of the anticipated audience, given the present low Windows phone market share, will not be hindered by an experience-based preference for first-party devices. We, the tiny, yet vocal enthusiast market, within the echo chamber of social media, comments sections and forums, reflect a particular mindset regarding a preference for first-party devices that is not entirely reflective of the rest of the market. Nor will it be the driver of the platform.

Microsoft wants there to be more partner devices than first-party devices in the market.

Microsoft has four Chinese manufacturing partners in Alcatel, Coship, Cube and Lenovo. There are six Japanese partners: Covia, Freetel, Mouse, Nuans, Vaio and Yamada. Plus Acer in Taiwan, Funker in Spain, and U.S.-based HP. These partners who have embraced Window 10 Mobile, and those to come are what will drive the platform. Between these OEMs we're seeing a range of devices from affordable to high-end. Future partners, influenced by first-party aspirational devices, will do the same.

Bringing it all together

Part of Microsoft's duo user strategy, as we've shared in previous parts of this series, is to get Windows phones into the hands of users with personal and professional needs by way of partnerships. Microsoft is building a phone for you through a Windows platform designed for the duo user. That platform implemented by a number of regional partners representing where the strategy is headed.

The company is reaching for consumers in the enterprise space. As some of the Windows 10 Mobile devices we've mentioned in this piece, are targeted specifically toward enterprise customers in various regions the platform is represented in an environment where Microsoft has an advantage. HP's support of the platform can potentially expose the strengths of Windows 10 Mobile as a personal and professional device to those who may not have otherwise considered it.

And thanks to the Universal Windows Platform, regardless of your device, Windows is Windows is Windows. UWP brings the synergy of the entire platform to the mobile component of Windows. The cohesion between devices, common development and user experiences is an advantage that Microsoft's pioneering UWP has brought to the platform.

Partnerships are the lynchpin in Microsoft's mobile strategy.

But Microsoft's key differentiator is Continuum. Continuum allows any Windows 10 phone supporting the feature to, in effect, become a PC. As we've seen in this final installment eight of the seventeen smartphones Microsoft's partners have brought to various regions, support this function. It is Microsoft's vision that the future of a Windows phone is that of a phone that replaces a PC:

If anything, we will want to continue to build that capability out…Just like how with Surface we were able to create a category. Three years ago most people would have said, "What is a two-in-one?" And now even Apple has a two-in-one. And so three years from now, I hope that people will look and say, "Oh wow, that's right, this is a phone that can also be a PC."

This vision will require Microsoft's continued support of the entire platform as well as the reciprocated support of OEM partners. We not only see this support reflected in the consistent build releases to Windows across the desktop and mobile and the OEM partners we identified in this piece, but we see a commitment from Microsoft as reflected in this memo to Microsoft partners below:

"I understand that you are hearing concerns from certain partners about Microsoft's commitment to the mobile space. Let me be very clear: We are committed to deliver Windows 10 on mobile devices with small screen running ARM processors. We are currently in development of our next generation products and I wanted to reconfirm our commitment to Windows 10 Mobile. We believe in this product's value to business customers and it is our intention to support the Windows 10 Mobile platform for many years. We have a device roadmap to support that from Microsoft as well as our OEM partners who will also be selling an expanded lineup of phone devices based on this platform."I want to assure you that your investment in Windows phones is not at risk. The mobility of the Windows 10 experience remains core to our More Personal Computing ambition. We will continue to support and update the Lumia devices that are currently in the market, and the development of Windows 10 phones by OEMs, such as HP, Acer, Alcatel, VAIO, and Trinity; as well as develop great new devices. We'll continue to adapt Windows 10 for small screens. We'll continue to invest in key areas – security, management, and Continuum capabilities – that we know are important to commercial accounts and to consumers who want greater productivity. And we'll help drive demand for Lumia devices.With this focus, our Windows strategy remains unchanged: 1. Universal apps. We have built an amazing platform, with a rich innovation roadmap ahead. Expanding the devices we reach and the capabilities for developers is our top priority. 2. We always take care of our customers, Windows phones are no exception. We will continue to update and support our current Lumia and OEM partner phones, and develop great new devices. 3. We remain steadfast in our pursuit of innovation across our Windows devices and our services to create new and delightful experiences. Our best work for customers comes from our device, platform, and service combination

As we look at all of the pieces together we see a comprehensive strategy being executed. Microsoft's duo user personal and professional approach combined with a focus on the Universal Windows Platform of which mobile is a part unifies the ecosystem. Partnerships with regional and globally recognized OEMs and efforts to bring apps to the platform via the app Bridges, Xamarin and the Bot Framework, help to integrate much-needed support to the ecosystem.

Though success is by no means guaranteed Microsoft is committed to developing the ecosystem and the partnerships that are key to the success of the mobile component of the UWP and their duo user strategy.

Wrap up

Finally, these manufacturers have brought their Windows 10 Mobile phones to market within this last year, or will be releasing theirs in the coming months. These recent commitments by OEMs to Windows 10 Mobile reflect the confidence that they have in the Windows 10 Universal Windows Platform and Microsoft's continued support of the same.

OEMs have deemed Windows 10 Mobile a strategic investment.

Though some industry watchers and critics have an opposing view of Windows 10 on phones and Redmond's commitment to it, one must be careful not to impose their views on a growing list of OEMs who clearly have a different perspective. We cannot to transfer our feelings of disappointment to manufacturing partners, assuming they feel the same. It is certain that they have measured the risks and necessary resources and deemed Windows 10 Mobile a calculated and solid investment toward their individual strategic goals. They are, after all, investing their money to that end. And if there's anything we can agree on, money talks.

So, tell us, were you aware of these thirteen OEM partners who are making Windows 10 Mobile phones? Are you aware of any others? Does knowing of this level of manufacturer support change your perception of the state of the platform or where it is headed? Let's hear your thoughts in the comments below and on Twitter !

If you missed any parts of this series catch up here!

Jason L Ward is a Former Columnist at Windows Central. He provided a unique big picture analysis of the complex world of Microsoft. Jason takes the small clues and gives you an insightful big picture perspective through storytelling that you won't find *anywhere* else. Seriously, this dude thinks outside the box. Follow him on Twitter at @JLTechWord. He's doing the "write" thing!