Here's how to find your next credit card with the best rewards, bonuses and perks

Find a credit card in under a minute

Heads up! We share savvy shopping and personal finance tips to put extra cash in your wallet. Windows Central may receive a commission from The Points Guy Affiliate Network. Please note that the offers mentioned below are subject to change at any time and some may no longer be available.

What you need to know

- Match to credit card offers you are more likely to qualify for without impacting your credit score.

- Find cards with low interest, cash back, balance transfers, and travel rewards.

- See your matched offers in less than 60 seconds.

Finding the right credit card for your needs and your lifestyle, while also taking into consideration your credit score, is no small feat today. There is a seemingly endless barrage of information from financial websites, bloggers, and YouTubers, not to mention the countless offers that find their way to you from your current or prospective card issuers and banks. It can be easy to get caught up in the limited time offers, the new card on the block, or even the superior, flashy design of one credit card over another (I'm looking at you Jony Ive).

On top of all of this, those who are looking for your business are getting smarter. They're gathering data and targeting all of us with more specific cards and offers that will entice us even more than before, and they're using all of their options to do it. Mailers, emails, and ads on social media are just scratching the surface of how deep these advertising campaigns are going. In addition, card issuers are embracing exclusive or pre-selected offers. We've all seen a card offer come through and say "you've been preselected to apply!", touting a limited-time, exclusive offer just for you.

With all of these cards out there, with multiple offers going on for each card, how do we find the right card and the right offer for us? Do we wade through dozens of credit card websites, blog posts, and YouTube videos? You could, and if you want to get that deep into the rabbit hole that is the credit card industry, you probably should just write for us. However, if you just want a simple way to search for a credit card that gives you the rewards and benefits you want, with a solid welcome offer to go along with it, CreditCards.com has a new solution.

What is CardMatch?

CardMatch is like Tinder, but for matching you to a credit card instead of a, just maybe, an actual human being (hello bots). However, it gets better than that, because the credit cards that are hoping to match to us don't ask for or receive the treasure trove of data that we've come to expect from most services on the internet today.

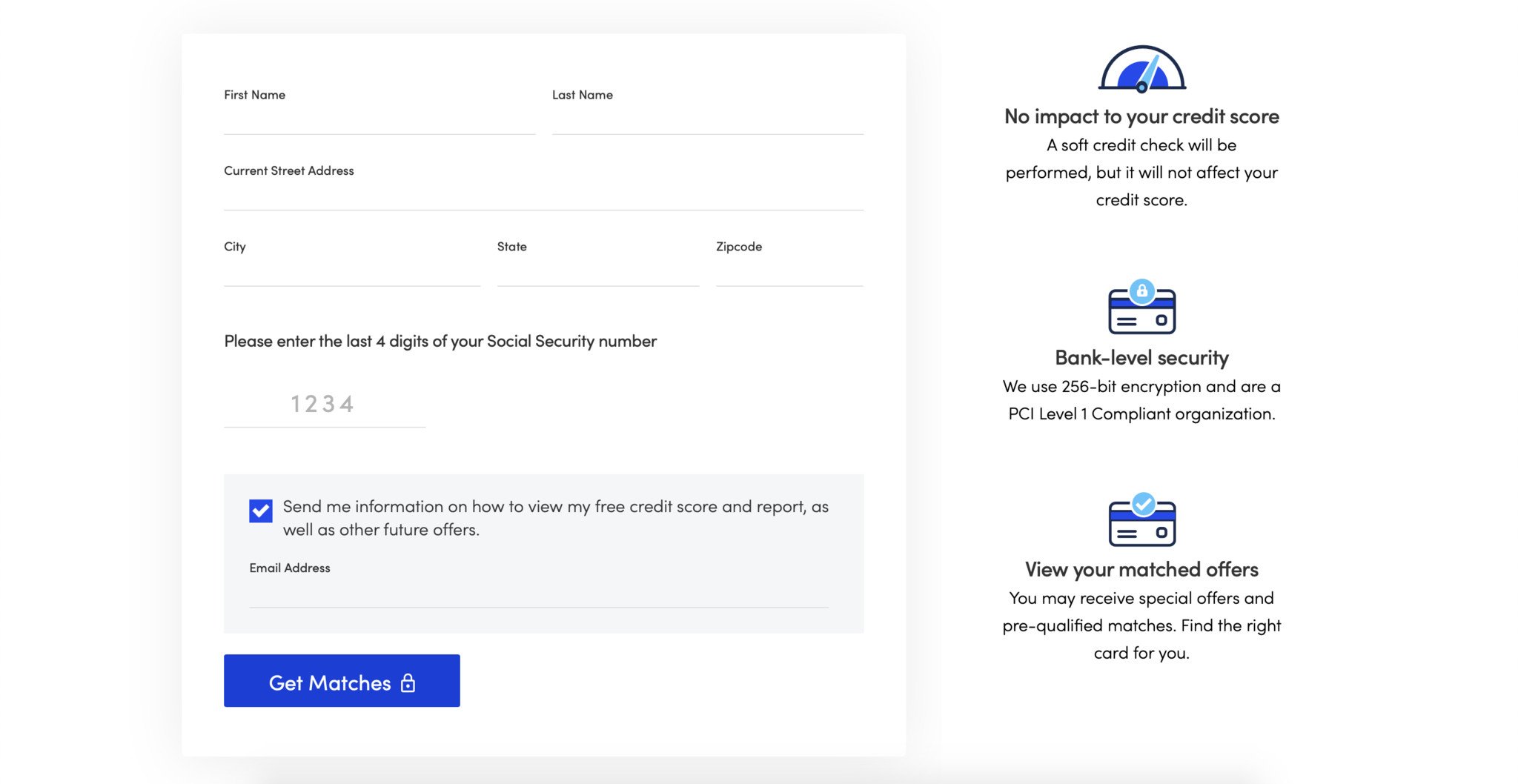

Using CardMatch only performs a soft credit check, meaning that finding your potential card will not impact your credit score. The service uses 256-bit encryption and is considered a PCI Level 1 Compliant organization, meaning that the data that you do have to enter in to use the service is secure. The information that you do need to enter in order to use the tool is your first name, last name, address, and the last four digits of your social security number. You also can give them your email to receive a free credit report and future offers that they proactively find on your behalf, but this is completely optional.

Get your CardMatch offers in just seconds

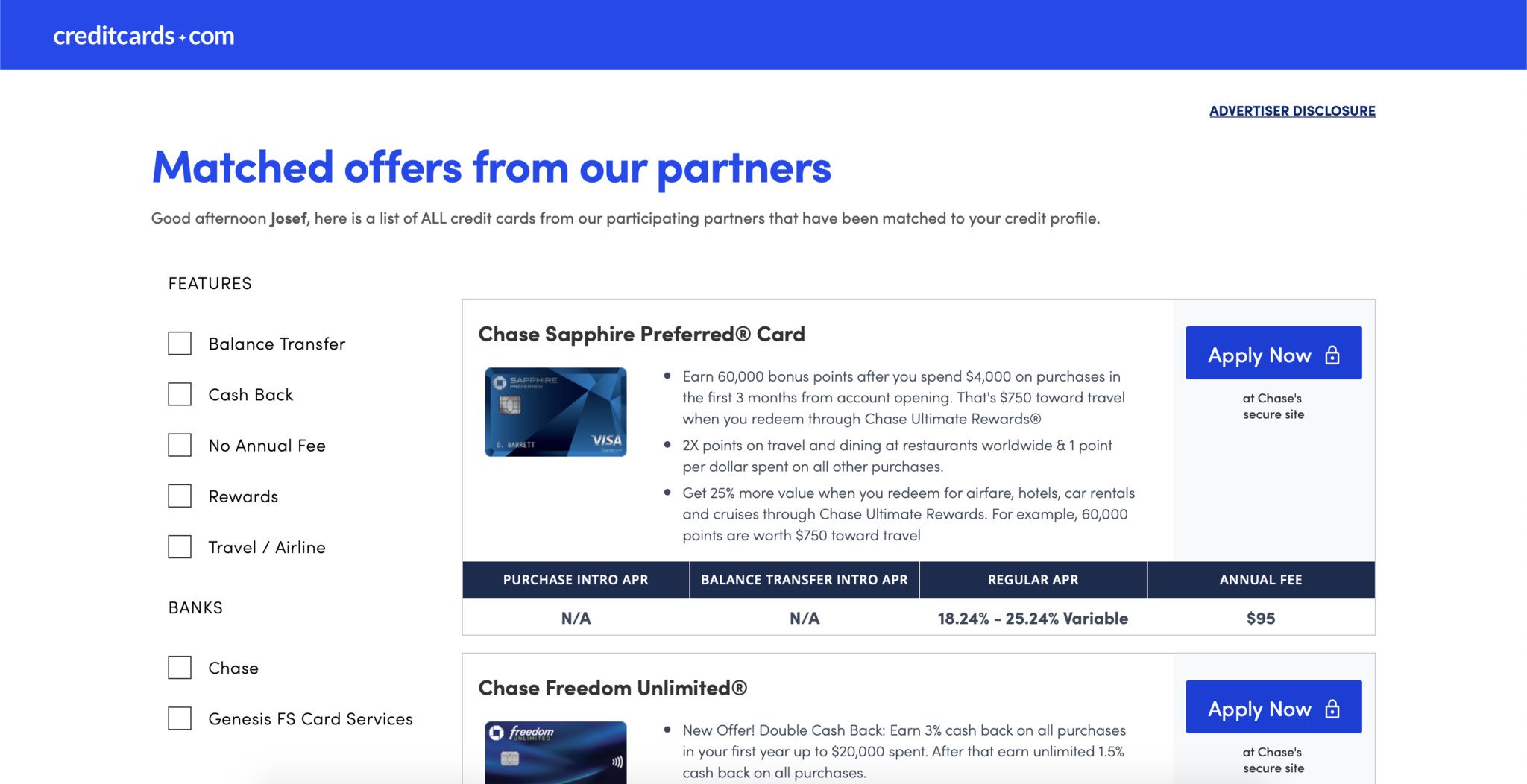

One thing to keep in mind is that CardMatch doesn't work with all credit cards in existence. It only features credit cards that have partnered with CreditCards.com. However, being one of the biggest financial websites in the world, they've partnered with a ton of credit card issuers. Some of the companies that are featured are American Express, Bank of America, Capital One, and Chase, so you're sure to have plenty of options to choose from.

How to find and apply for your best match

If you'd like to take CardMatch for a test drive and see what kinds of cards and offers are available to you, start by visiting the CardMatch website.

The homepage of the CardMatch website is where you get started. Enter your First Name, Last Name, Address, and the last four digits of your Social Security Number. Also, choose if you would like to receive a free credit report and future offers. Then click Get Matches.

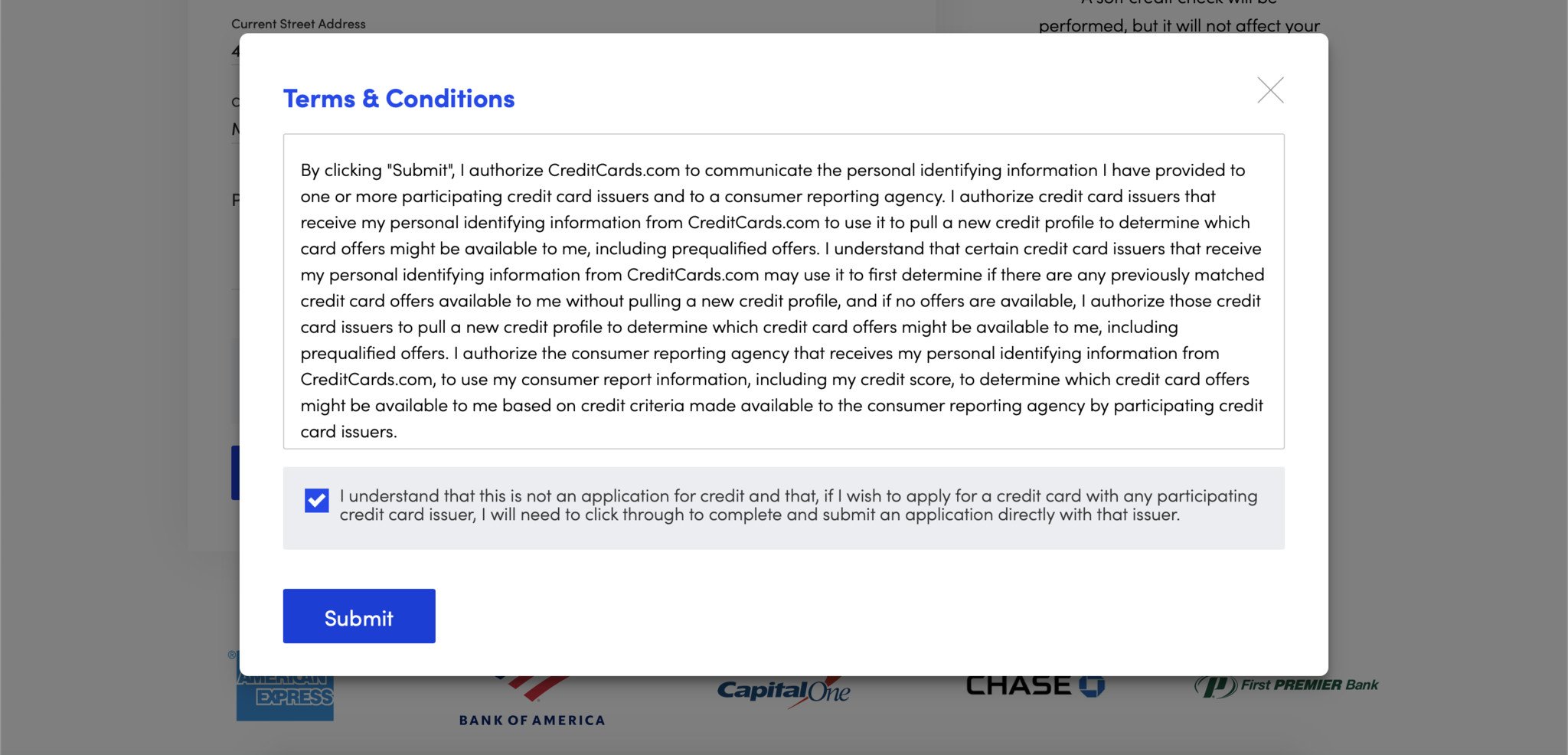

Next, you'll have to accept the terms and conditions. Feel free to read all of it, but the basic idea is that you are agreeing to the fact that you have willingly given your information to receive credit card offers from CreditCards.com and its partners. If you agree, check the box and click Submit.

In less than a minute, CardMatch will take you to the results page and show you all of the cards and offers available to you from its partners. You can filter your results by card features such as Balance Transfer, Cash Back, No Annual Fee, Rewards, and Travel/Airline. You can also choose to filter offers down by bank if you are a huge fan of one over the others. Each card listed will show you some of the highlights of the card's benefits, as well as any welcome bonuses if currently offered. It'll also list the card's Purchase Intro APR, Balance Transfer Intro APR, Regular APR, and Annual Fee.

The results you get will vary over time as card companies are constantly changing their partnerships and the offers they run on their cards, so if you want to use the tool once and not have to go back time and time again, entering in that email address to get proactive future offers is a better way to go. If you find an offer that you like, click on Apply Now and you'll be taken to that card company's website to finish your application.

Should you use it?

If you love diving into the deep end of the credit card pool and spend hours sifting through articles and videos to find a credit card and offer for you, then go for it! However, if you want a tool that will do 90% of the work for you and get you a few great offers without having to dig through the depths of the internet, CardMatch is hoping to be that solution for you. It definitely takes a lot of the legwork out of the equation and can save you time and earn you more rewards. It's also newer, so as CreditCards.com gets more companies to partner with it, it will only get smarter and give you better offers. If you're ready for a tool to do the hard work for you, give CardMatch a try.

Get the Windows Central Newsletter

All the latest news, reviews, and guides for Windows and Xbox diehards.