Here's what you need to know about India's revolutionary Unified Payments Interface

We're finally moving to a cashless economy.

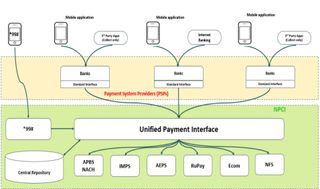

The National Payments Corp. of India has launched a new payment architecture called Unified Payments Interface. The initiative is aimed at making banking services accessible to a wider audience, while reducing a lot of the pain points involved in online banking.

With UPI, you can use your phone to send and receive money using a unique identifier called the UPI ID (or a virtual address). The UPI ID is all you need to transfer or receive funds, and unlike traditional NEFT or RTGS services, UPI will be available 24 hours a day, seven days a week.

What is the Unified Payments Interface?

The Unified Payments Interface is a nation-wide unified payment architecture that's designed to drive the country toward a cashless economy. The Reserve Bank of India has identified that just six non-cash transactions a year are being undertaken per person on average, with just over 10% of the 10 million retailers accepting card payments.

With the number of smartphone users set to hit 500 million within the next five years, UPI is seen as the way forward. Moving to a digital payments system also allows the government to curb the country's black money problem.

The RBI defines its objectives with the initiative thusly:

To offer an architecture and a set of standard APIs to facilitate the next generation online immediate payments, leveraging trends such as increasing smartphone adoption, Indian language interfaces, and universal access to Internet and data.

How can I set it up?

You can set up UPI by linking your Aadhaar number, credit or debit card number, or your bank account. With UPI, you don't need to know the recipient's name, bank account, or the bank's IFCS code. All that's required is the unique UPI ID for a transaction to go through. The system is similar to Immediate Payment Service (IMPS), but has a daily limit of ₹1 lakh.

UPI is both a push and pull platform, meaning that you can pay someone ("push") as well as receive funds ("pull"). There's also a collect option that will come in handy for merchants, and you can even pre-authorize recurring payments for utilities, loans, subscriptions, and the like.

Get the Windows Central Newsletter

All the latest news, reviews, and guides for Windows and Xbox diehards.

UPI is interoperable as well, which means that you can transfer money to an account in another bank instantaneously. The service will also be integrated into e-commerce, letting you purchase items online by entering your UPI ID instead of your card details. In terms of security, you'll get a one-time password as soon as you authorize a transaction. The biggest draw with the initiative is that you no longer have to share sensitive information when conducting a transaction.

The NPCI has several use cases listed in the UPI charter.

When can I start using it?

Very soon. The NPCI has partnered with over 19 banks for UPI-based payments. The banks are in the process of rolling out updates to their mobile apps, following which you will be able to leverage the service.

In addition, e-commerce vendors are also getting in on the action. Flipkart has acquired PhonePe earlier this month, and is now working on a UPI-based payments solution. From co-founder Sachin Bansal:

In a lot of ways, cash on delivery and wallets exists in the interim until we find the final version (of payments). We are hoping that UPI will solve the last-mile final gap and make our experience for users a magical one.

Unified Payments Interface has the potential to revolutionize payments in the country. With the service set to be rolled out over the coming weeks and months, we will have much more to share on how you can get started and use UPI to the fullest extent.

Harish Jonnalagadda is a Senior Editor overseeing Asia for Android Central, Windows Central's sister site. When not reviewing phones, he's testing PC hardware, including video cards, motherboards, gaming accessories, and keyboards.