Microsoft's Surface revenue plummets by 30%: Market overcrowded, buyers elusive, and PC sales in crisis

Microsoft has too many Surfaces in addition to “declining PC demand.”

What you need to know

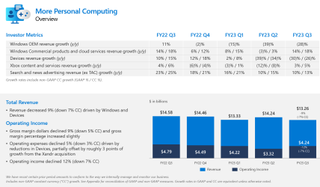

- Microsoft revenue was down 9% year-over-year in its More Personal Computing division.

- Windows OEM revenue declined by 28%, while Surface was down 30%.

- A weak PC market, driven by external economic headwinds and too much inventory, is hurting the Surface division.

Microsoft’s FY23 Q3 results are out today, and while overall, the company is doing well with $52.9 billion in revenue (up 7%), the gains were primarily driven by cloud, LinkedIn, servers, and commercial products. That $52.9 billion surprised Wall Street, which expected $51 billion. As a result, Microsoft's stock is up 5% in after-hours trading.

Turning to the consumer angle with some enterprise crossover is the More Personal Computing division, which includes Windows, Surface (“devices), Xbox and gaming, and search. Unfortunately, that part of Microsoft is not doing great, with a decline of 9% year-over-year, due to the waning demand for Surface and Windows.

Windows OEM revenue declined by 28% due to “elevated channel inventory levels,” which is corporate speak for too many in-stock products (from its OEM partners) and not enough people buying them. Microsoft notes that this is “beyond declining PC demand,” which suggests it is doing a bit worse than the market.

Not all is bad, however, as commercial Windows OEM products and cloud services grew 14%, driven by “strong renewal execution and an increase in agreements that carry higher in-period revenue recognition.”

Turning to Microsoft Surface, which the company calls “devices,” revenue is down 30%, again related to “elevated channel inventory levels” and a weak PC market.

Last quarter was worse for Microsoft as Surface saw a steeper 39% drop in revenue, but compounded with today's 30% report, and Microsoft is losing quite a bit compared to previous quarters with no end in sight.

Search (Bing) and news advertising (MSN) are up 10%, excluding traffic acquisition costs driven by “higher search volume and the Xandr acquisition.”

Get the Windows Central Newsletter

All the latest news, reviews, and guides for Windows and Xbox diehards.

Finally, Xbox and gaming revenue was down 4%, but content and services, driven by Xbox Game Pass, grew by 3%, suggesting Microsoft is still onto a long-term winning formula for gamers. Xbox hardware revenue, however, was also down by 30%, which again means consumers are not spending as much as they did a year ago due to inflation and recession concerns.

Windows Central’s Take

Unfortunately, none of this news is too surprising. We recently reported how even Apple, with its highly touted M1 and M2 processors, saw a 40% decline in shipments, according to IDC. It is unclear how that translates into Apple’s revenue, but the company tends to have high-profit margins on its hardware. Indeed, one report said things were so bad Apple halted M-processor manufacturing in January and February to prevent “elevated channel inventory levels.” Apple resumed chip production in March, but only at half the previous level.

But, besides the apparent decline in the overall consumer market for new expensive purchases, Microsoft may have some other lingering issues tied to an aging and arguably less-interesting product lineup. For example, Surface Laptop 5 and Surface Pro 9, while generally well-reviewed, seemed to have landed with a thump. Likewise, Surface Duo 2 is discontinued and has no replacement until sometime in 2024.

Indeed, we’ve heard through our reporting that due to “elevated channel inventory levels,” Microsoft has pushed back devices like Surface Go 4 and Surface Laptop Studio 2 until the fall instead of its initially planned spring release. The company reportedly has too much on-hand stock of older hardware to clear out first, and launching in a weak PC market wouldn’t help.

The PC market may not return to more robust levels until 2024, assuming a recession doesn’t grip the world’s economy. But it also remains to be seen if Microsoft can renew consumer interest in its usually exciting Surface hardware.

Daniel Rubino is the Editor-in-chief of Windows Central. He is also the head reviewer, podcast co-host, and analyst. He has been covering Microsoft since 2007 when this site was called WMExperts (and later Windows Phone Central). His interests include Windows, laptops, next-gen computing, and wearable tech. He has reviewed laptops for over 10 years and is particularly fond of 2-in-1 convertibles, Arm64 processors, new form factors, and thin-and-light PCs. Before all this tech stuff, he worked on a Ph.D. in linguistics, performed polysomnographs in NYC, and was a motion-picture operator for 17 years.

-

g4gn0n Reply

They are great devices but they're getting a little pricey too. Adding a little thickness and weight can get you a system with a dedicated low end gaming graphics card for the same price as their cheapest laptops.Windows Central said:Microsoft's FY23 Q3 results are in, and, at least for More Personal Computing, things are not looking great due to a very weak consumer market and declining demand for Surface hardware. Here's what you need to know.

Microsoft's Surface revenue plummets by 30%: Market overcrowded, buyers elusive, and PC sales in crisis : Read more -

Jcmg62 Of course, it would help if Microsoft bothered to launch products worth buying.Reply

I thought the whole idea of the Surface brand was to create cutting edge devices that would inspire OEM's to copy them. That seems to have fallen by the way side.

In 2022 we saw the Pro 9 and Laptop 5, both decent devices but hardly inspirational, and certainly not worth upgrading to. And then there was the Studio 2. Once again, Microsoft managed to release an insanely expensive machine with out of date hardware. How? And why?

2023 looks set to be another dull and uninspired year from Surface. An Arm Surface Go. That's the big reveal? Weak.

In a year where Google launch the Pixel Fold and Apple drop their VR experience, Microsoft are responding with an underperfoming laptop.

Not a great time to be a Surface fan. -

BINARYGOD Reply

Sure, the reasons are for some reason beyond the obvious market forces people have been predicting and talking about and then proven correct about for years at this point, it's instead your opinion on how "boring" they are that matters. Let's also ignore that Apple is down 40%, doing even worse. Guess they are boring too, or rather, people will magically have better reasons/excuses for them - like... the easily predictable outcomes everyone saw coming post pandemic and during an economic downturn.Jcmg62 said:Of course, it would help if Microsoft bothered to launch products worth buying.

I thought the whole idea of the Surface brand was to create cutting edge devices that would inspire OEM's to copy them. That seems to have fallen by the way side.

In 2022 we saw the Pro 9 and Laptop 5, both decent devices but hardly inspirational, and certainly not worth upgrading to. And then there was the Studio 2. Once again, Microsoft managed to release an insanely expensive machine with out of date hardware. How? And why?

2023 looks set to be another dull and uninspired year from Surface. An Arm Surface Go. That's the big reveal? Weak.

In a year where Google launch the Pixel Fold and Apple drop their VR experience, Microsoft are responding with an underperfoming laptop.

Not a great time to be a Surface fan. -

BINARYGOD Reply

True, but just how little is little, and what qualifies as low-end in these examples. Surfaces are largely not gaming focused at all, so thinner and not stuff with power hungry gaming stuff is appropriate (The Steam Deck, for an imperfect comparison, is a loser in the battery life department).g4gn0n said:They are great devices but they're getting a little pricey too. Adding a little thickness and weight can get you a system with a dedicated low end gaming graphics card for the same price as their cheapest laptops. -

rainbowrunner32 Reply

Quick call out on the numbers - the 30% loss is comparison to last FY, not the previous quarter. Its not a compounded 30% loss - its a 30% loss vs the same quarter of the previous FY. y/y vs q/qWindows Central said:Microsoft's FY23 Q3 results are in, and, at least for More Personal Computing, things are not looking great due to a very weak consumer market and declining demand for Surface hardware. Here's what you need to know.

Microsoft's Surface revenue plummets by 30%: Market overcrowded, buyers elusive, and PC sales in crisis : Read more