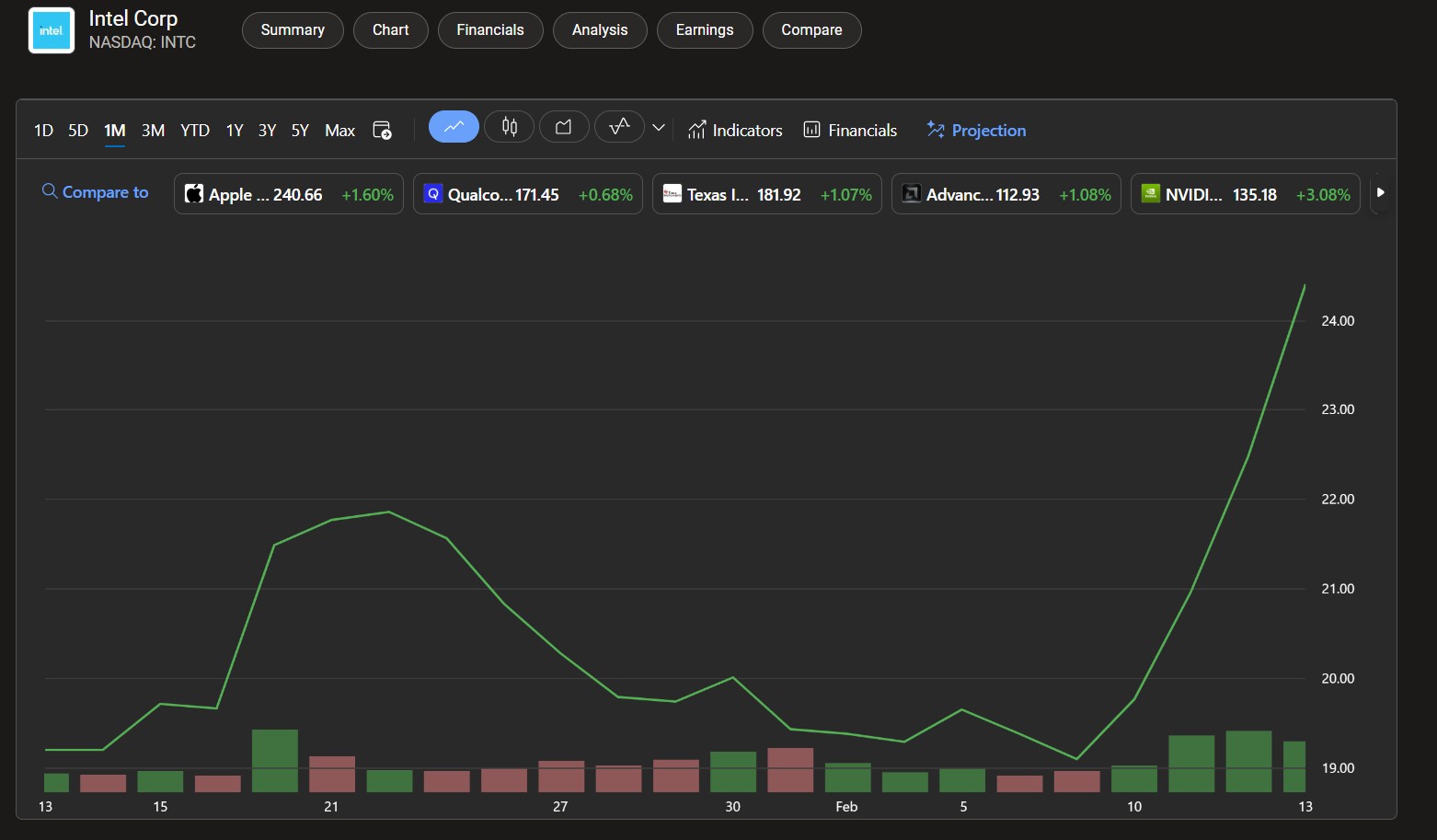

Intel stock soars almost 25% in one week after JD Vance' new comments on the chip maker's AI future, as the US and UK refuse to sign the Paris AI summit's regulation decree

Intel has struggled to find its footing in a silicon landscape dominated by NVIDIA, but the Trump administration's "America first" approach might have thrown the chip maker a big lifeline.

Intel has not had a good few years, but things might be looking up for the beleaguered chip maker.

Over the past year, Intel has laid off thousands upon thousands of staff, following its disastrous attempts to build a home-grown chip fabrication business, typically known as Intel Foundry. The firm saw its valuation practically wiped out over the past few years as a result, with its market cap shrinking to lows not seen since the mid 90s.

Investors have largely been placing their bets on NVIDIA in the artificial intelligence wars, given that the server technology built by the firm has become the de facto default for building generative AI platforms. Microsoft, Meta, xAI, and others have placed orders in the multi-billions for chips from NVIDIA for their data centers, leaving Intel and AMD in the dust. However, the political landscape might just be turning in Intel's favor.

At the recent Paris AI summit led by France, U.S. Vice President JD Vance shared some interesting comments during his speech (via Barron), which seem to have excited investors.

“The Trump administration believes AI will have countless revolutionary applications in economic innovation, job creation, national security, healthcare, free expression and beyond. [...] To safeguard America’s advantage the Trump administration will ensure that the most powerful AI systems are built in the U.S. with American designed and manufactured chips."

Indeed, the United States has been trying to limit dependence on countries like Taiwan and China for building out its AI aspirations. Both the Democrats, and Republicans have lobbied to build home-grown semiconductor solutions, to reduce the dependence on TSMC. The firm produces some 90%+ of the world's most sought-after chips, and the Trump administration has targeted Taiwan with tariffs in an attempt to force businesses to consider home-grown solutions instead.

For the United States, AI is a national security issue

JD Vance's comments were seen by many investors as a positive sign of more support for Intel, which remains a significant player in the space. Intel might have missed out on opportunities to be a bigger player with smartphones, server tech, and graphics processing, but it is enjoying a lot of home-grown support via the CHIPS act, which allocated billions in funding to United States-based companies.

Get the Windows Central Newsletter

All the latest news, reviews, and guides for Windows and Xbox diehards.

For the United States and other western countries, artificial intelligence is increasingly seen as a national security issue. Indeed, lots of western tech firms saw their stock prices battered when a Chinese start up, with its DeepSeek model, seemed to reproduce OpenAI's ChatGPT results for far cheaper.

The first countries to really achieve true "AGI" in sci-fi terms could see rapid advancement in technological breakthroughs, with computers able to understand context and experiment far more rapidly than humans. To that end, the Paris AI Action Summit aimed to draw nations into an agreement to regulate AI development, to focus on making it "open, ethical, safe, and secure," given the potential the technology has to actually do serious harm to humanity as well. The United States and United Kingdom buddied up to refuse signing the act. JD Vance criticized the regulations, saying that it would "kill an industry that is just starting to take off," while a UK government spokesperson said "it didn't provide enough practical clarity."

Jez Corden is the Executive Editor at Windows Central, focusing primarily on all things Xbox and gaming. Jez is known for breaking exclusive news and analysis as relates to the Microsoft ecosystem while being powered by tea. Follow on Twitter (X) and Threads, and listen to his XB2 Podcast, all about, you guessed it, Xbox!

You must confirm your public display name before commenting

Please logout and then login again, you will then be prompted to enter your display name.