NVIDIA is the most profitable semiconductor chip brand in the world due to the rise in demand for AI GPUs, with Meta and Microsoft as its A-list clients

Demand for its AI chips makes NVIDIA the most profitable chipmaker for Q3 2023.

What you need to know

- NVIDIA's revenue for Q3 2023 currently stands at $18.12 billion, with profits at $10.42 billion, which makes it the most profitable semiconductor chip brand ahead of Intel and Samsung.

- This translates to a 206% year-over-year increase due to the high demand for AI chips.

- Microsoft and Meta are its biggest clients, buying 150,000 H100 GPUs each.

The US government recently imposed new exportation rules on chipmakers like NVIDIA, banning them from shipping AI chips to China over security concerns. This happened shortly after President Biden issued an Executive Order addressing AI safety and privacy concerns, which consequently blocked a shipment worth $5 billion headed to China.

Biden's administration insists that the move isn't in place to run down China's economy but to ensure safety guardrails are in place to ensure the technology isn't leveraged for ill purposes. However, China has seemingly found a workaround for this via its GPU recycling factories. The move has negatively impacted China and chipmakers shipping the components.

But despite all these setbacks, NVIDIA has seemingly emerged victorious, taking the crown as the most profitable semiconductor chip brand in the world ahead of Samsung and Intel, according to Tom's Hardware.

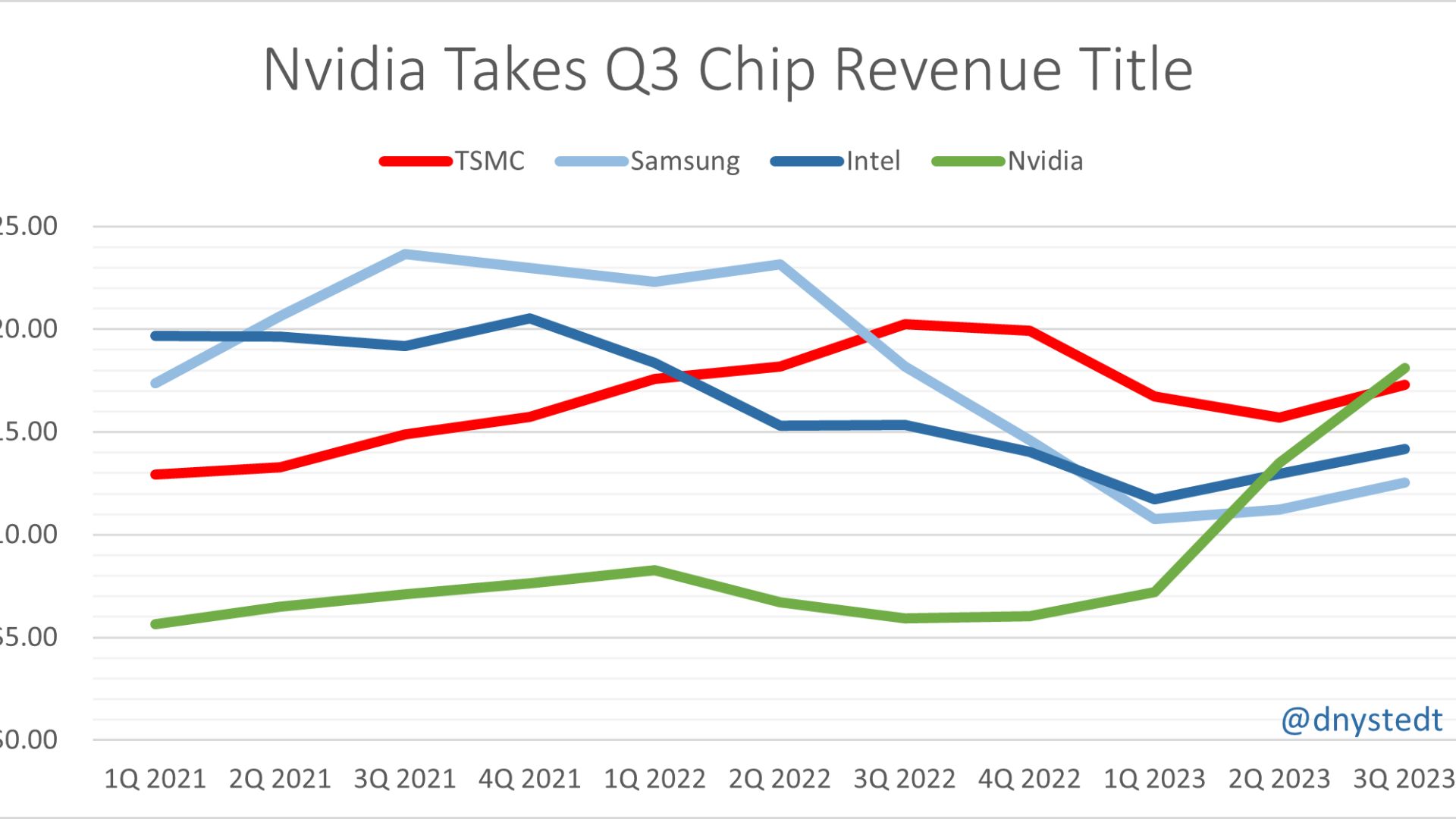

Nvidia swooped in and took the 3rd quarter chip industry revenue crown, beating out TSMC, Intel and Samsung as the generative AI trend continues to strengthen.Nvidia could win 2nd place in full-year chip revenue in 2023, beating Intel and Samsung, while TSMC remains on track to…November 24, 2023

Rising demand for AI turns lucrative for NVIDIA

This doesn't come as a surprise, given the high demand for chips due to the rapid growth of generative AI-related ventures. In Q1 2023, NVIDIA came in at fourth place, but it has since climbed the ropes and is now the largest semiconductor firm in Q3 2023.

RELATED: Microsoft enters the chip game with its own Arm processors for AI and computing workloads

According to Taipei-based financial analyst Dan Nystedt's findings, NVIDIA's revenue for Q3 2023 currently stands at $18.12 billion, while its profit is $10.42 billion. This translates to a 206% year-over-year increase, with most of the profit stemming from AI chip sales.

Per a report by Omdia (which specializes in market tracking), Meta and Microsoft are NVIDIA's largest purchasers of H100 GPUs. Each company bought approximately 150,000 H100 GPUs from the chipmaker, which is significantly more than what Google, Amazon, Oracle, and Tencent purchased when combined — each purchased 50,000 processors.

Get the Windows Central Newsletter

All the latest news, reviews, and guides for Windows and Xbox diehards.

TSMC, on the other hand, generated $17.28 billion in revenue and made a $7.21 billion profit. Intel staggered behind it with $14.16 billion and $8 million in losses. Finally, Samsung generated $12.52 billion in revenue and made significant losses of $2.86 billion. Samsung is arguably the largest memory chipmaker, but it's facing losses due to the drop in price for memory chips and the fact that potential customers have become more cautious when making purchases of these components.

Do you think NVIDIA will be able to meet the rising demand for AI chips? Share your thoughts in the comments.

11/29 Deals STILL AVAILABLE!

- Walmart: Cyber Monday+ deals

- Dell: Top deals on laptops, gaming PCs, etc.

- Alienware: Up to $800 off gaming laptops + desktops

- Best Buy: Big savings on video games + accessories

- HP: Up to 84% of select HP Windows PCs + accessories

- Lenovo: Up to 50% of gaming towers + laptops

- Newegg: Save on PC gaming accessories + components

- Razer: 43% off laptops + accessories with free gifts

- 🚨HOTTEST Trending deals:

- Microsoft Surface Go 3 |

$339$261 at Microsoft - Xbox Series S (512GB) + Game Pass Ultimate |

$299.99$249 at Walmart - Xbox Series X (1TB) |

$549.99$449.99 at Best Buy - 1TB Xbox Expansion Card |

$149.99$139.99 at Best Buy - Stormcloud Vapor SE controller:

$69.99$59.99 at Amazon - Meta Quest 3 (128GB) | $499.99 at Newegg

- ASUS ROG Zephyrus G14|

$1,599.99$1,149.99 at Best Buy - ASUS ROG Ally + Game Pass Ultimate|

$599.99$429.99 at Best Buy - Game Pass Core (12 months) |

$59.99$44.99 at Target - Surface Pro 9 (Certified Refurb) |

$939$639 at Microsoft

Kevin Okemwa is a seasoned tech journalist based in Nairobi, Kenya with lots of experience covering the latest trends and developments in the industry at Windows Central. With a passion for innovation and a keen eye for detail, he has written for leading publications such as OnMSFT, MakeUseOf, and Windows Report, providing insightful analysis and breaking news on everything revolving around the Microsoft ecosystem. While AFK and not busy following the ever-emerging trends in tech, you can find him exploring the world or listening to music.