Gartner data shows Nokia and Microsoft face intense battle against Samsung and Apple

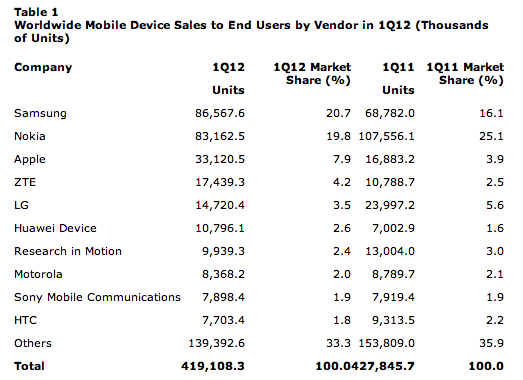

Industry research firm Gartner just released its latest data on mobile phone sales for the first quarter of 2012. There are some interesting points to be pulled out of this report that I wanted to address.

Samsung dominates Android. Gartner’s data says that Korea-based Samsung shipped over 40% of all Android handsets last quarter. So that still leaves 60% of the market to other vendors, right? Yes, but according to Gartner none of these other vendors make up more than 10% of Android volume. None.

In terms of handset brands, Samsung is also now the #1 phone maker in the world, ahead of Nokia.

Nokia may have the #2 position in the market, but we need to remember that most of Nokia’s volume is based on the dying Symbian OS. Very little is based on its Windows-powered future at this point. So, considering that we’re looking at the death of the dumphone over the next few years, let’s look at smartphone vendors and volumes.

Samsung is the #1 player, having shipped 38 million smartphones. Most of these are Android powered, with a smaller number of Bada OS phones. Here’s how smartphone market share looks, by vendor, based on the Gartner data:

- Samsung with 26% market share

- Apple with 23%

- RIM with 7%

These are essentially the top 3 smartphone players right now. I realize that ZTE, LG and Huawei have a larger portion of the mobile market than RIM, but RIM is a pure play on smartphones whereas these three are not. Remember that other Android vendors have less than one quarter of Samsung’s volume.

What does this data mean to Windows Phone?

Back in late Feb, I wrote a post on Crackberry about how we’ll know if RIM is successful. In that article I suggested that, as the mobile phone market moves purely to smartphones, RIM could go from 3% market share to over 5%. I said they’ve got a shot at being the #4 player behind Samsung, Apple and Nokia (not necessarily in that order).

Get the Windows Central Newsletter

All the latest news, reviews, and guides for Windows and Xbox diehards.

Although other vendors, such as HTC, have talked about building Windows Phone products, we all know that Nokia is the only true partner at this point. And it’s still early days in terms of understanding how this will all unfold.

Nokia’s big challenge is to migrate its customer base form a dying Symbian platform over to Windows Phone. That’s going to be a HUGE challenge in the developing markets, especially given the cost differential between cheap Symbian phones and expensive Windows powered phones. So it seems to me that Nokia could fall off the map here, ending up with much, much less market share than their current 19.8%.

Ideally, Microsoft would benefit form the support of more manufacturing partners. But if they can’t win more vendors over, they may as well buy Nokia and control their entire platform just as Apple and RIM do. For that matter, even Google is ready to fully control Android (via the Motorola acquisition) in the event that Samsung somehow moves to control its own platform.

I like Microsoft’s strategy of converging the user experience on mobile and desktop. It’s differentiated. Microsoft has always been a company who delivers great developer tools. Microsoft needs to win over developer momentum here, badly.

But, unfortunately, if either Microsoft of Nokia stumble here, the chances of Windows Phone becoming a dominant platform shrink significantly.

Nokia is still the # 2 global player in the mobile phone market. This is a good base on which to convert customers over to Windows Phones. But every quarter that Nokia bleeds share to the competition (mainly Android), the race gets much harder.