Xbox is on track to knock Sony PlayStation down to third place for the first time in history

With combined Activision and Xbox revenues, Sony PlayStation may be looking at a third-place software and services spot behind Microsoft for the first time.

What you need to know

- Microsoft and Sony have long been intense rivals in the high-end console gaming market, with Sony typically out in the forefront by almost every metric.

- Despite Xbox's console market share woes, Microsoft has found a ton of success by expanding across to PC and doubling down on services.

- Now that Microsoft has acquired Activision-Blizzard (the makers of Call of Duty), Microsoft may be on course to leapfrog Sony's gaming revenues for the first time in history.

- Tencent remains the top dog by a mile, owing to investments in companies like Epic Games, domination in China, mobile titles, and ownership of League of Legends' Riot.

Microsoft has long touted its goal to become top dog in the gaming industry, while also stating that its eyes are on players like Apple and Tencent rather than PlayStation and Nintendo in order to achieve those goals. Indeed, the top player in the industry is indeed Tencent. The Chinese tech giant has massive investments in companies like Epic Games with Fortnite, as well as a dominant position in service PC and mobile games in both Western and Eastern markets in general. Apple, despite making no games or gaming hardware of its own, has also long been comfortably ahead of Microsoft, owing to massive taxes it imposes on developers in its iOS app stores. The landscape is rapidly changing, however.

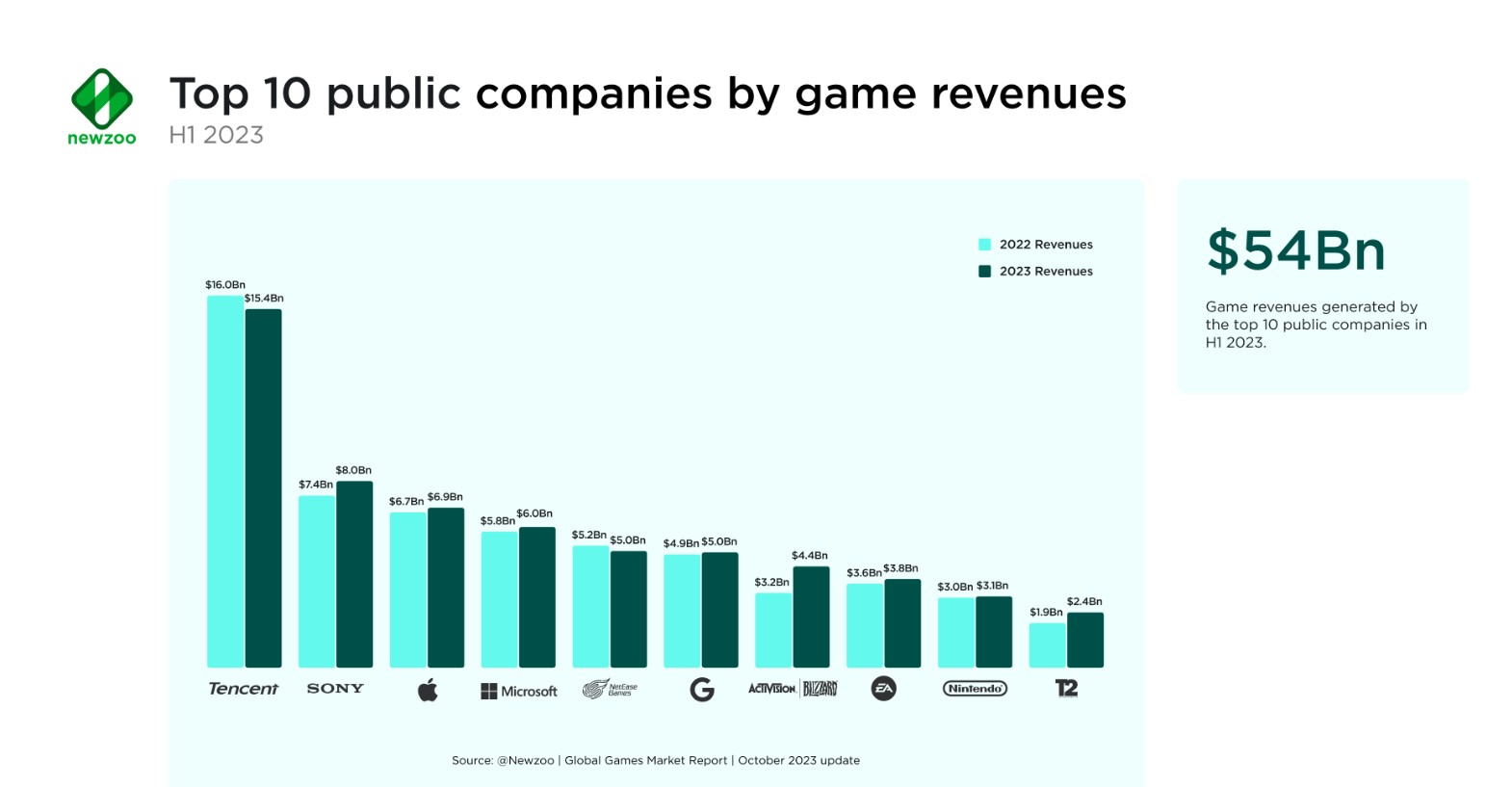

Analysis firm Newzoo recently released a detailed report (via @superhys) into the games industry for H1 2023, revealing a familiar top 10 lineup. Newzoo projects that the games industry will generate $184 billion in revenue for the entirety of 2023 fiscal, and they forecast that it'll grow to $205.7 billion by 2026. The lion's share of gaming software revenue remains in mobile, although PC and console did see growth, while browser-based games continue their freefall decline. Mobile gaming also saw a small decline, but remains 49% of the overall pie, with console and PC sharing 29% and 21% respectively.

When you start to look at the breakdown per company, things get more interesting. Tencent is miles ahead of the pack, with a dominating position in service games across all platforms. Tencent's League of Legends esports 'Worlds' event for 2023 became the most-watched esports event in history this past week, and it retains a 40% stake in Epic Games, makers of Fortnite and the Unreal Engine. In the west, the firm represents some direct competition for Activision-Blizzard via Riot Games, whose titles undoubtedly took inspiration from staples Blizzard were previously known for.

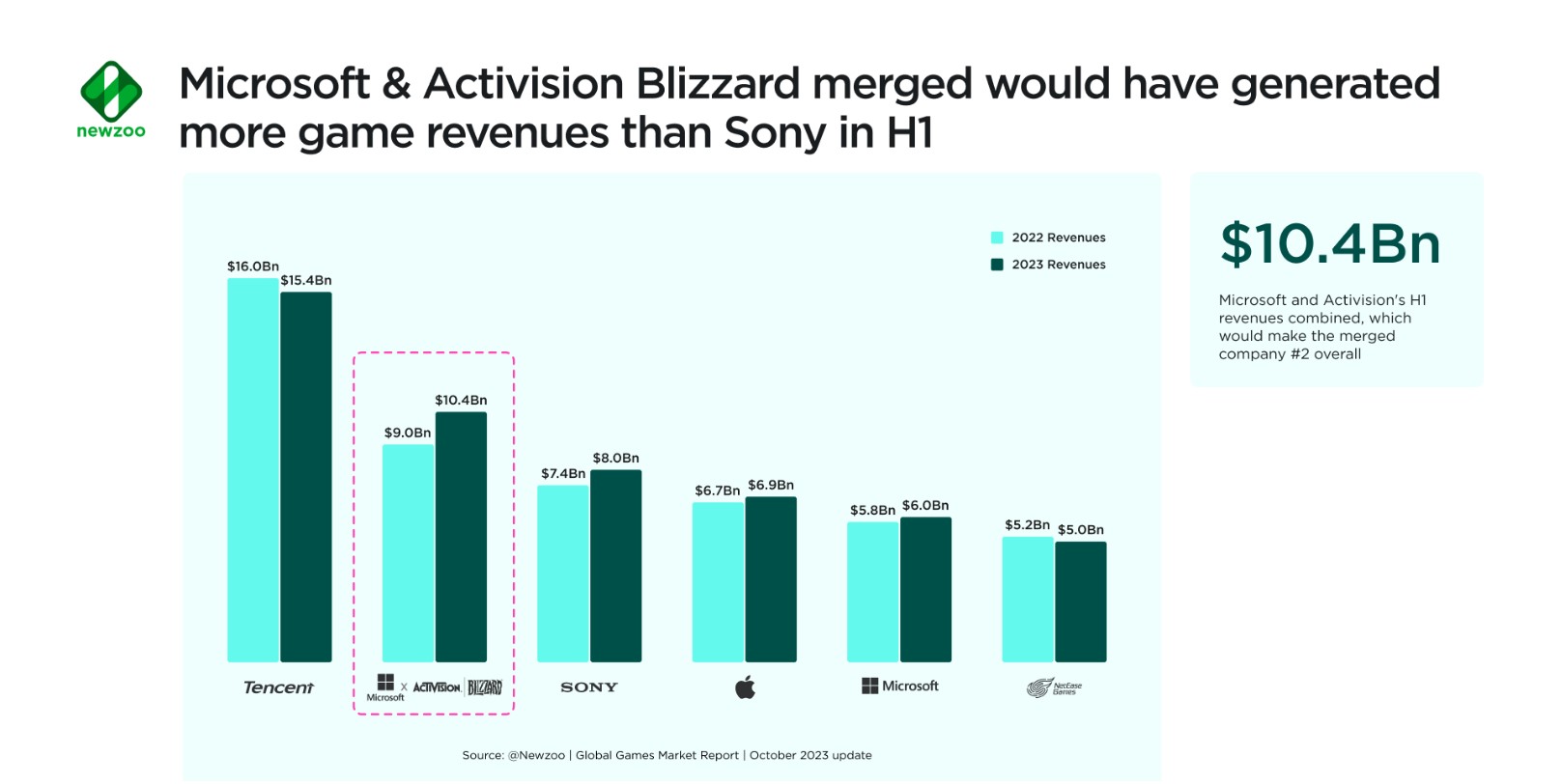

Speaking of which, Activision-Blizzard is now very much a part of Microsoft, owing to a lengthy acquisition process this past 18 months. The transaction only became finalized in October, precluding Activision's revenue from being counted as part of Microsoft's for H1 2023 fiscal. Newzoo took the liberty of projecting what the chart might look like had those software and service revenues been combined, however, as you can see below.

In a world where Microsoft and Activision's revenues were combined, for the first time in gaming history, Microsoft will supplant Sony PlayStation as the second biggest gaming company. It's emblematic of Microsoft's desire to emulate Tencent in this space, producing service games that exist across all platforms, as opposed to the more traditional closed console ecosystem approach that works well for PlayStation and Nintendo. Microsoft has also told investors to expect a near 50% increase in gaming revenue for its next quarter, owing to the combined revenue streams.

Other developments could further upset the balance. Apple has been designated a "gatekeeper" tech firm by the European Union, which means they will be forced to open up their platform to third-party app stores and side-loading of apps from 2024. Microsoft has been incredibly transparent about its desire to build an Xbox mobile game store, and is dedicating a significant amount of resources to that end. If Microsoft can deprive Apple of revenues from Call of Duty Mobile, Minecraft, and other major third-party games by offering a better revenue split, it could help further Microsoft's goal to create the "Steam of mobile." Personally, I think it's a long shot. Samsung already offers something similar with its own Galaxy Store, and has barely made a dent on Android, but maybe Microsoft has a secret weapon that we have yet to uncover.

A changing landscape with plenty of room for all

• Handpicked: The best deals overall

• Xbox accessories under $100

• Early gaming laptop deals

• Early graphics card deals

• Gaming TV early deals

• Early motherboard deals

• 4K and Ultrawide monitor deals

• Early deals on power banks

• Xbox controller deals for October

Newzoo noted that the top 10 companies generated 50% of all gaming software and service revenue. Despite that concentration, the diversity of business models is quite stark. PlayStation and Nintendo focus entirely on their own hardware ecosystems with PC and mobile a virtual afterthought, while Tencent, the top player, doesn't make hardware at all. The chart doesn't include hardware revenues, which would partially explain the oversized gap between Tencent and PlayStation. Microsoft is modeling itself after Tencent to that end, while also supporting a hardware ecosystem. It perhaps makes Microsoft the most diversified now, with a strong offering in mobile games with Activision, an entrenched position in Western console markets, and increased visibility on PC owing to services like Xbox Game Pass. Still, the challenges for Microsoft are still quite abundant.

Get the Windows Central Newsletter

All the latest news, reviews, and guides for Windows and Xbox diehards.

Xbox Series X and Xbox Series S hardware sales continue to dip year-over-year, and lag behind even that of the Xbox One, despite how maligned that console's launch was. Microsoft's strategy of putting its games day and date onto PC is undoubtedly having an impact on the desirability of its own console hardware, and I would argue the lack of innovation and investment in console features has contributed to a reduction in excitement and interest in the platform. Sony has plowed ahead with experimental accessories like PSVR, its PlayStation Portal streaming handheld, and pioneering haptics in its controllers. The Xbox Series X|S by comparison actually shed features from its predecessors, losing Kinect, SPDIF audio optical, and HDMI pass-through, by comparison. Leaked documents also suggested that Microsoft has no interest in building its own Xbox handheld, despite clear demand for devices like the Steam Deck and ASUS ROG Ally.

Related: Full H1 2023 Games Industry report via Newzoo

Microsoft does have a strong slate of upcoming Xbox games that should help move the needle, but even Starfield, despite a huge marketing campaign, seems to have failed to help the Xbox Series X|S's fortunes.

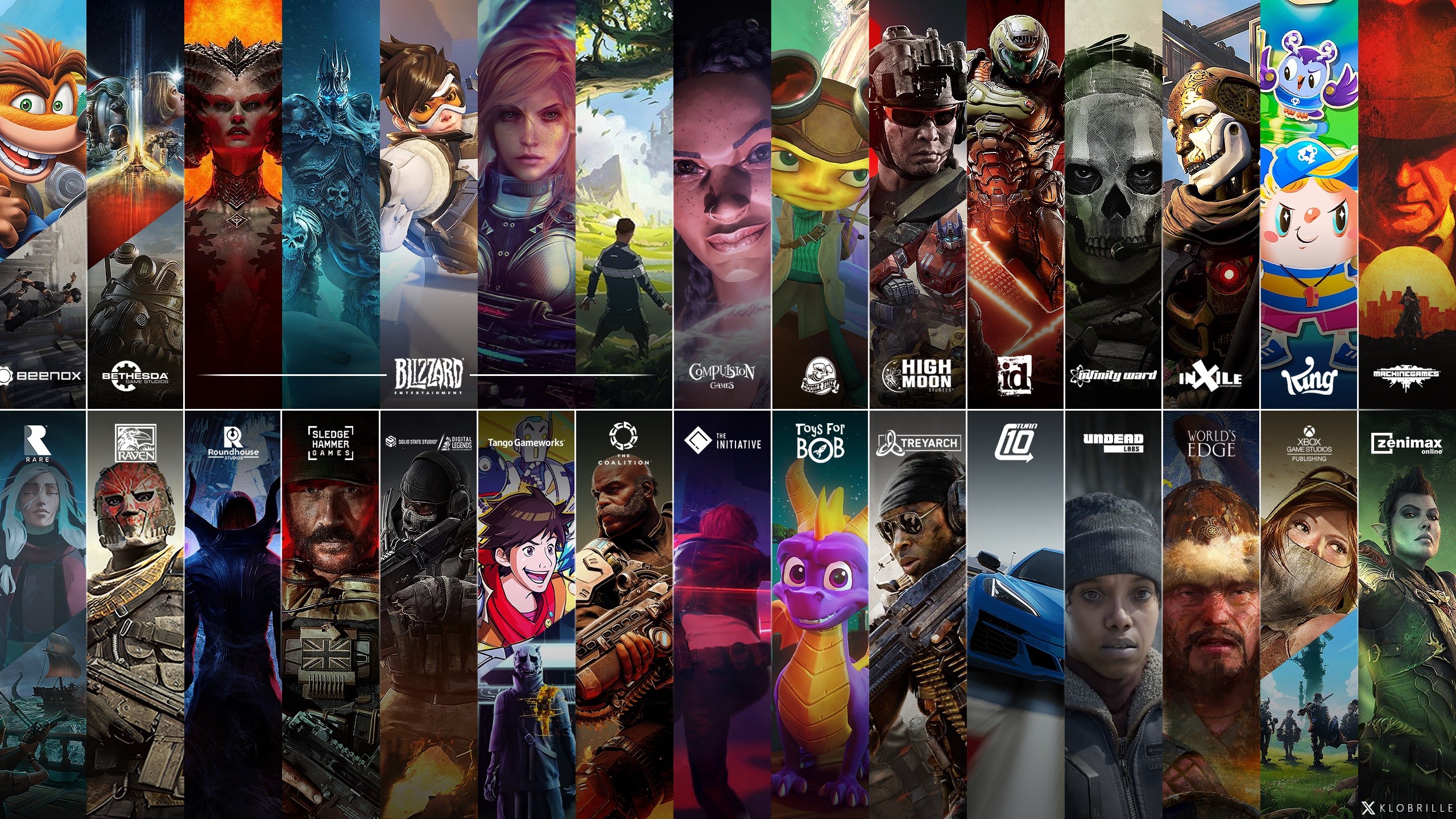

Xbox's future is undoubtedly secure either way. Its unearned "underdog" status is now surely shed, owing to the vastness of its combined portfolio with Activision-Blizzard and ZeniMax, and the diversity of its offerings across every platform. As a fan of the traditional Xbox console hardware ecosystem, though, I hope Microsoft has more tricks up its sleeve to reverse its fortunes in that space as well.

Jez Corden is the Executive Editor at Windows Central, focusing primarily on all things Xbox and gaming. Jez is known for breaking exclusive news and analysis as relates to the Microsoft ecosystem while being powered by tea. Follow on Twitter (X) and Threads, and listen to his XB2 Podcast, all about, you guessed it, Xbox!