This GameStop stock fiasco is getting out of hand

What is a short squeeze and why you should care.

What you need to know

- The U.S. government is monitoring the situation with GameStop's stock, which has been the subject of booms in day trading.

- Brokerage firms like TD Ameritrade have also restricted trading.

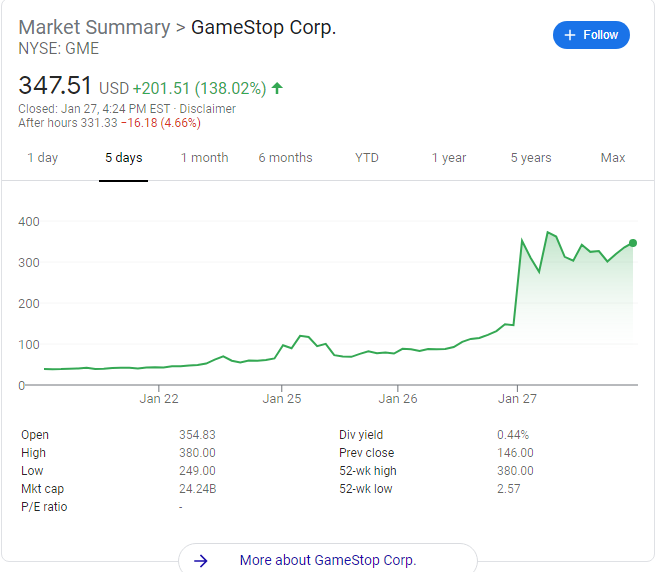

- GameStop's stock has skyrocketed over the past week thanks in part to subreddits like WallStreetBets and other platforms, which noticed how shorted the stock was.

The GameStop stock market fiasco has gotten so bad that the U.S. government is monitoring the situation.

White House press secretary Jen Psaki told reporters on Wednesday that, "our economic team, including Secretary Yellen and others, are monitoring the situation." She added, "It's a good reminder, though, that the stock market isn't the only measure of the health of our economy."

Senator Elizabeth Warren agreed with Psaki's comments, writing on Twitter that "it's not news that the stock market doesn't reflect our actual economy."

"For years, the same hedge funds, private equity firms, and wealthy investors dismayed by the GameStop trades have treated the stock market like their own personal casino while everyone else pays the price," she continued. "It's long past time for the SEC and other financial regulators to wake up and do their jobs – and with a new administration and Democrats running Congress, I intend to make sure they do."

For years, the same hedge funds, private equity firms, and wealthy investors dismayed by the GameStop trades have treated the stock market like their own personal casino while everyone else pays the price.For years, the same hedge funds, private equity firms, and wealthy investors dismayed by the GameStop trades have treated the stock market like their own personal casino while everyone else pays the price.— Elizabeth Warren (@SenWarren) January 27, 2021January 27, 2021

GameStop has been at the center of business news this week, not because of anything the company did but because of booms in day trading that began on the subreddit r/WallStreetBets, other platforms like Robinhood, and people like Elon Musk on Twitter. It's hard to explain for people who don't follow markets, but here's the rundown on why this began happening. Essentially, WallStreetBets noticed how shorted GameStop's stock (traded as GME) was thanks to financial firms like hedge funds, which would sell stock they didn't have and then buy them back at a lower price.

This is where it gets tricky. If the stock doesn't drop when the traders have these shares that don't exist (they're typically borrowed), they get "squeezed" since they have to cover the shares they sold. They'll end up owing money instead of earning it. GameStop is at the top of MarketWatch's recent most shorted stocks list, followed by companies like Bed Bath & Beyond, AMC Networks Inc., and fuboTV.

According to Motherboard, which has a great explainer up, GameStop was a specific target because the company issued more shares than were available, so short sellers took the stock hostage. Then, WallStreetBets saw an opportunity. It's become so popular that WallStreetBets has had to monitor traffic. Reddit has also been experiencing some technical issues on Wednesday, but Reddit hasn't confirmed if it's related to increased traffic due to the GameStop story.

All the latest news, reviews, and guides for Windows and Xbox diehards.

Now we're here just over a week later, and Gamestock is the biggest story in video games. Even CNBC commentator and Mad Money host Jim Cramer is weighing in, telling people not to invest in GameStop.

"I've never seen the guns like this. They can break shorts," he said.

It's tough to say whether this was a deliberate attack on hedge funds and other venture capital firms or if it was mostly a troll by a subreddit. One redditor said it was to send a message to "market manipulators, and others agreed. It's likely a combination of both. It's already had some impact, though. One of the hedge funds that was shorting GameStop, Melvin Capital, confirmed that it was closing out after suffering a huge loss. Gabe Plotkin had to raise billions in bailout money amid the squeeze and has since left his position.

Brokerage houses like TD Ameritrade and Charles Schwab also announced Wednesday that they are restricting trading for GameStop, AMC (another shorted stock), and others to mitigate "risk for our company and clients."

Meanwhile, there have been testimonials all over WallStreetBets from people who claim to have benefited greatly from the situation. One said that it was able to help them get through a "very rough year."

GameStop itself has not yet commented on the situation.

Carli is the Former Gaming Editor and Copy Chief across Windows Central, Android Central, and iMore. Her last name also will remind you of a dinosaur. Follow her on Twitter or email her at carli.velocci@futurenet.com.