12 days of tech tips: The holidays are the perfect time to embrace mobile payments

Ah, the holidays, when the weather gets cold and snowy (for many of us), the stress levels shoot up (and up and up), and we make (way) more purchases than usual, in attempts to find and secure the best gifts for our friends and loved ones. For the majority of consumers, that means using credit or debit cards more than usual, and perhaps at a wider range of retailers, some more secure, and therefore more trustworthy, than others.

Smartphone-based mobile payments aren't new. But many people still resist them, for fear of putting their financial info at risk, or just because using traditional credit cards has worked fine for them so far. So why change?

The answer is a simple one: Mobile payments are more secure than using your credit card, whether it's for an online purchase or in store. If you've been hesitant to go all-in on mobile payments, the holiday season is a great time to change that — and protect your credit, and your cash, in the process.

What exactly are mobile payments?

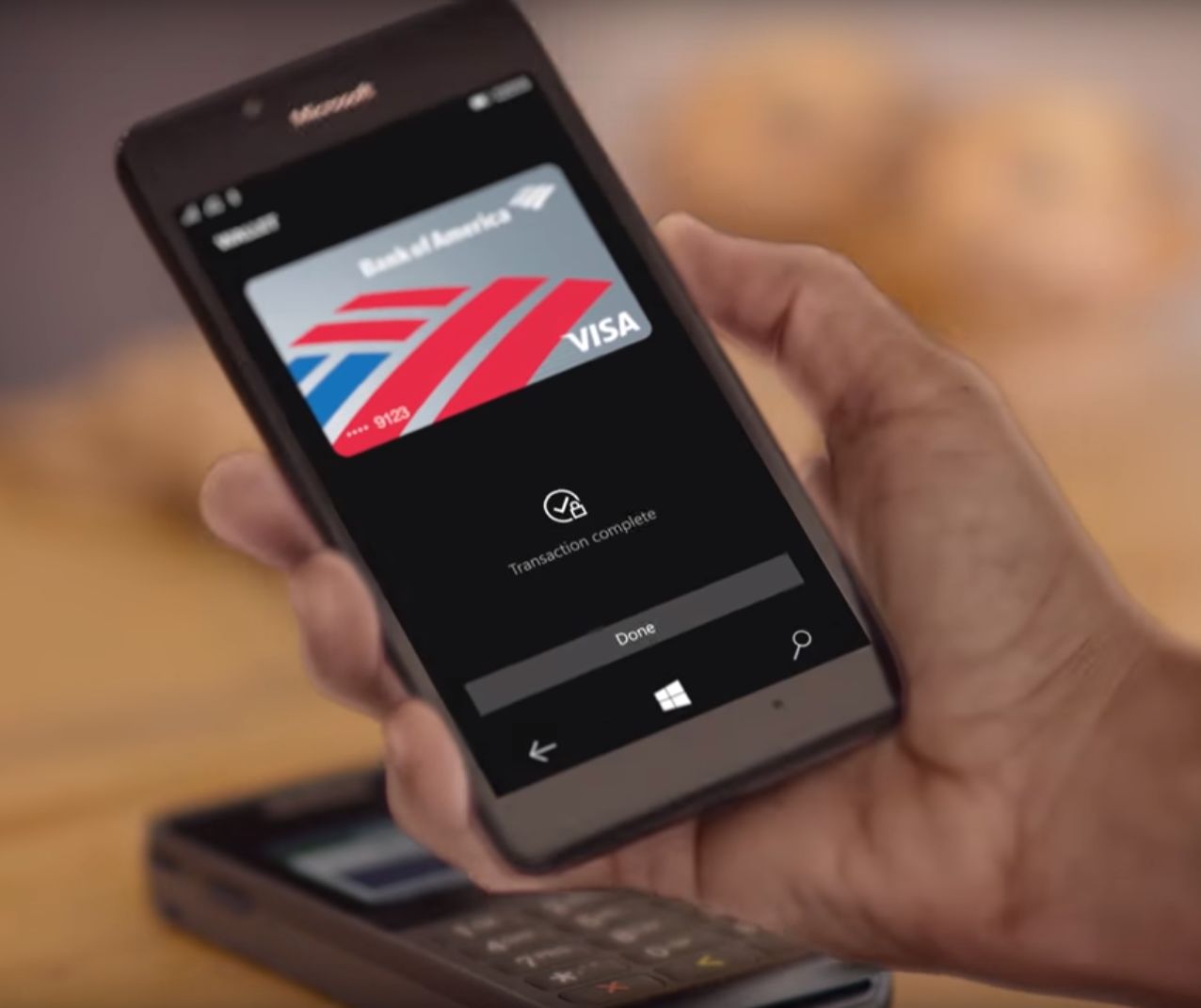

All of the leading mobile platforms have some version of a mobile payments system, and most of them work similarly. On Windows 10 Mobile, you have Microsoft Wallet. Android has Android Pay, and on Samsung phones, there is Samsung Pay. iOS users have Apple Pay.

In stores, these systems use a short-range wireless tech called Near Field Communications (NFC) to securely transfer your data from your phone or wearable to a compatible point of sale (PoS) system at retailer's cash register. Samsung Pay is unique in that it also supports tech called Magnetic Secure Transmission (MST), which sends a randomized version of the information stored in your payment card's magnetic strip to a PoS system. Retailers need to have newer NFC-compatible PoS devices to support NFC, and therefore Microsoft Wallet, Android Pay, and Apple Pay. So newer Samsung phones have an advantage in that department; they can be used at many more retailers than the competition.

You can also use these systems to pay for purchases online, assuming you're using the necessary browser or device. For example, you need to use Microsoft Edge to take advantage of Microsoft Wallet online, and you can pay for online purchases via Apple Pay if you surf with Safari.

How do mobile payments work?

Before sending your payment information to a compatible PoS system or online retailer, mobile payment systems create a randomized "token" that contains your information (typically a unique device ID and transaction number), that can only be used once and that protects your actual credit card or banking information, so the retailer never actually sees it.

Get the Windows Central Newsletter

All the latest news, reviews, and guides for Windows and Xbox diehards.

When you use your AmEx card at McDonalds, for example, Ronald McDonald (and that other sweaty clown who took your order) can actually see your full credit card number. Or when you order flowers for your mom online, and you enter all your payment details, including expiration dates and that short code on your card, the retailer can see it all.

Are mobile payments really more secure?

Absolutely.

If you use Microsoft Wallet, Android Pay, Samsung Pay or Apple Pay, in store or online, retailers never actually see or store your specific payment details. Neither do Microsoft, Apple, Google or Samsung. So if that clown at McDonald's gets any bright ideas about swiping some credit cards, your info will be safe, because you never shared your actual number. And if that flower seller gets hacked, and all the financial information on her servers gets stolen, you're in the clear; all they received from you was a one-time device code and transaction number.

The basic idea is that instead of sharing your payment information with an endless list of retailers as you shop, and then dealing with the consequences, you share your info with only your mobile platform provider, therefore limiting the potential risk.

What if your phone gets stolen? You cannot make mobile payments without some form of personal or biometric authentication. So someone who has your phone who shouldn't would need a password, pin, fingerprint, or face or iris scan to make a purchase, depending on your device.

If your credit or debit card gets stolen you're immediately at risk, at least until you cancel the card.

How can I tell if my phone supports mobile payments?

Some of the latest Windows phones support mobile payments, including the Microsoft Lumia 650, 650 Dual SIM, 950 or 950 XL. Any iPhone from the past couple of years supports Apple Pay. The past few generations of Samsung's Galaxy phones support Samsung Pay, and just about any Android phone that has NFC can use Android Pay.

The easiest way to find out if you can use your phone for mobile payments is simply by searching Google. A query like "Does my XXXXX phone have NFC and mobile payments?," should yield a quick answer.

How do I use mobile payments?

The first step is setting the system up. You generally need to add your payment cards, and then verify your authentication information. We're not going to detail those processes here, because they're different for each system. But if you go to your phone's settings and look for the name of the supported mobile payment system, it should be intuitive. (Note: Not all banks and financial institutions support all mobile payment systems, so you may not be able to add all your cards. If you try to add a card that's not supported, your device will let you know.)

When you're ready to use your phone or wearable to pay, you may have to launch the related application. Then you simply hold it up to a compatible PoS device and authenticate when you're prompted, if necessary. That's it.

Your thoughts on mobile payments

Do you already use mobile payments? If so, what do you think? If you've been hesitant to use them, why? And are you willing to give them a try after reading this? Let us know if the comments. And have a happy (and safe and secure) holiday season.

Al Sacco is content director of Future PLC's Mobile Technology Vertical, which includes AndroidCentral.com, iMore.com and WindowsCentral.com. He is a veteran reporter, writer, reviewer and editor who has professionally covered and evaluated IT and mobile technology, and countless associated gadgets and accessories, for more than a decade. You can keep up with Al on Twitter and Instagram.